One in four people are now renting their home in Dublin, the highest figure since quarterly records began, with a new report predicting that the average rent in the capital will soar by 5-6 per cent a year to surpass €2,000 by 2019.

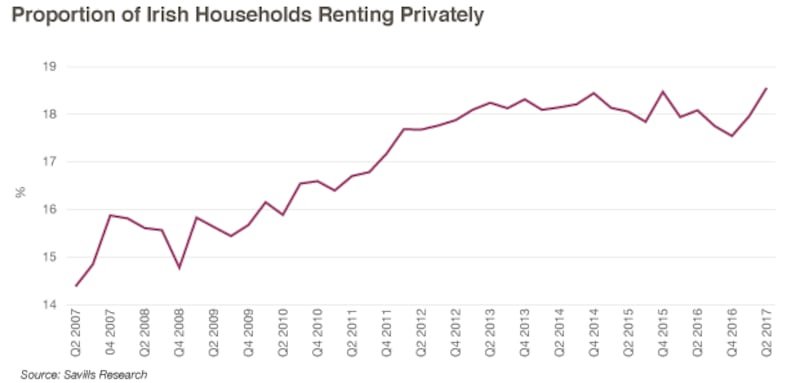

In a new analysis of Ireland's private rented market, John McCartney, economist with property agents Savills, finds that some 895,600 people are living in rented accommodation – up by 39,500, or 4.6 per cent, in the past 12 months, and by 42 per cent since the second quarter of 2007.

This represents 18.9 per cent of the population across the country, while in Dublin, the proportion of renters is at 24.3 per cent – these figures are the highest since quarterly records began.

They are also likely to be the highest since the home ownership boom began during the 1970s. Back in 2000, census figures show that the proportion of renters in Dublin was less than 10 per cent.

"Property prices continue to advance faster than average earnings, creating an affordability challenge to home-ownership which is driving people into the rented sector," Mr McCartney said, adding that he expects the proportion of renters to continue to rise.

This surge into the rental market means that the vacancy rate across Ireland is now just 1.31 per cent, or 1.41 per cent in Dublin, and Savills expects rents to keep rising until the market reaches the “equilibrium” rate of 5.6 per cent.

“However this will not happen within the foreseeable future and so the outlook is for further rent inflation,” Mr McCartney says.

‘Chronic shortage’

Savills expects the vacancy rate to improve to 2.04 per cent by December 2019, which means that the “chronic shortage” will persist for the medium-term, as Mr McCartney says that at current new-build rates, “there is more chance of it [vacancy rate] falling than rising” and it “certainly won’t rise appreciably” over the next four-five years.

This tight supply means that rents will continue rising. Mr McCartney expects rents to rise by 5-6 per cent a year in Dublin until the end of 2019, and by 7.2 per cent across the country.

Latest figures from Daft.ie show that the average rent across Ireland is now €1,198 nationally, or €1,819 in Dublin’s city centre, which means that by end 2019, rents could have risen to €1,376 and €2,024, respectively.

However, rental inflation may be higher in certain properties, and a two-tier market is likely to develop with higher rents on properties exempt from rent controls.

The surge in rents means renters are increasingly moving to the commuter belts, just like those who sought to buy before them did.

“It may get to point where you can’t even rent in Dublin,” says Mr McCartney, adding that we are going to see people increasingly “commuting to rent” – but without the benefit of owning their own property.

Mr McCartney also sounds a warning note about the inflationary pressures rising rents will have on the economy, in terms of wage claims, as well as the “human cost”, of people being forced to commute long distances because they cannot afford to rent in big cities.

Investors

Cash investors are also crowding out mortgage-financed landlords. The research shows about 61 per cent of privately-rented properties are owned outright by their landlords, up by almost 20 per cent since 2012. This means that just 39 per cent of rented properties have mortgages on them, down by 23,192 properties since 2012 – and 8,000 properties became mortgage-free in the last year alone.

For Mr McCartney, the flow is due to “small-time ordinary people” buying with cash and looking for a better yield on their money than that offered by deposits.