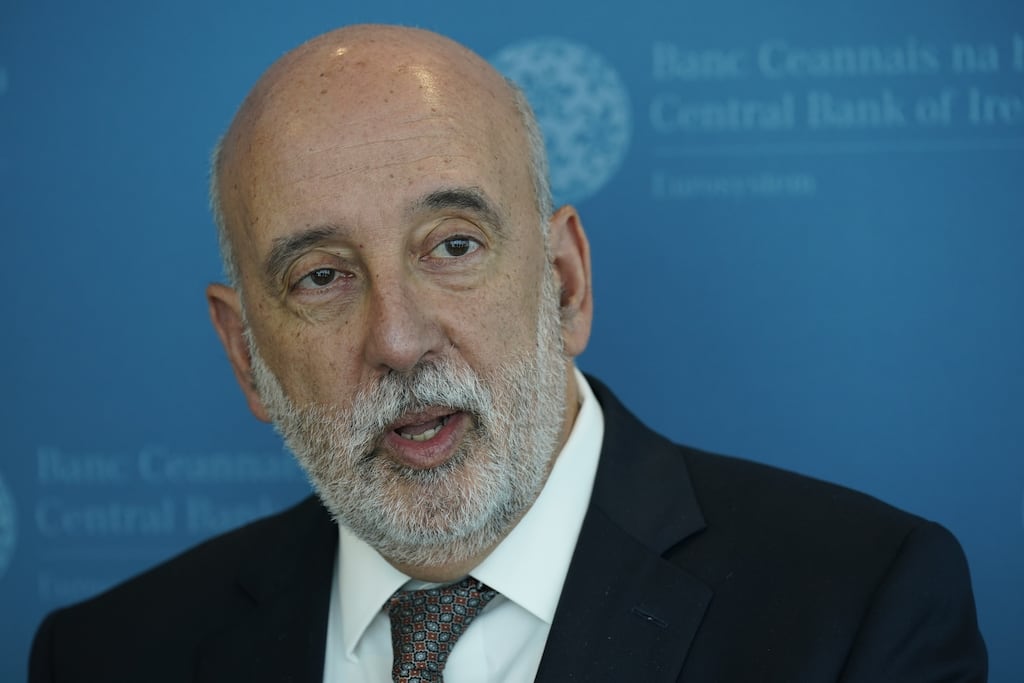

Central Bank governor Gabriel Makhlouf has stopped short of saying the European Central Bank (ECB) will begin cutting interest rates in June as markets are predicting but noted inflation was on a “positive” downward trajectory and that the bank was on course to hit its 2 per cent target rate of inflation.

Speaking after the ECB’s January meeting in which it kept interest rates at a record high of 4 per cent, Mr Makhlouf also praised the latest public sector pay deal, which will see civil servants getting pay increases of 10.25 per cent over two-and-a-half years, saying the agreement “seemed to strike the right balance between catching up with inflation without exacerbating the problem”.

If the Government’s deal is replicated across Europe “that would certainly help with inflation [across the bloc],” he said.

While ECB policymakers did not signal a change in its restrictive monetary stance on Thursday, markets are betting that the rapid fall in inflation over the last year will force a pivot in the coming months.

READ MORE

In Davos last week, several ECB policymakers firmly rejected expectations of a spring move on rates with ECB chief Christine Lagarde suggesting the summer as a more likely starting point.

“Monetary policy is working and we’re seeing disinflation ... inflation is tracking downward in the EU and also in Ireland,” Mr Makhlouf said.

[ What happens when a recession becomes more real than technical?Opens in new window ]

“I think we’ve probably reached the top of the ladder” or peak interest rates but the ECB would maintain a “data dependent approach” before making changes, he said.

The concern was that core or underlying inflation, a measure that removes volatile energy and food prices, remains “stickier,” the governor said. Core inflation in the Republic was 4.1 per cent in December and averaged 4 per cent throughout 2023.

The main driver was elevated rate price growth in the services sector, which was 5.2 per cent in December, up from the 2022 average. While this is typically driven across Europe by higher wages, a big component in Ireland was rents, he said.

Nonetheless, Mr Makhlouf said the ECB was in “a good place” to achieve its 2 per cent inflation target in the medium term and while the euro zone and Irish economy would see weaker levels of growth there would be a “soft landing”.

The biggest short-term threat to the Irish economy was a worsening geopolitical situation. As a small, export-led economy, Ireland was more at risk from an abrupt change in the global trade environment than other countries, he said.

While shipping problems in the Red Sea had not yet affected energy prices in any material way, “it all depends how long it continues and if it gets any worse.”

Separetly Latvia’s central bank governor Martins Kazaks said “confidence and patience” were the best ways to describe the ECB’s current thinking.

“Confidence because monetary policy is working – we see inflation has come down,” he said. “And patience – we’re data dependent, we’re not date-dependent. We’ll see what the data tell us,” he told Bloomberg Television.

- Sign up for push alerts and have the best news, analysis and comment delivered directly to your phone

- Find The Irish Times on WhatsApp and stay up to date

- Our In The News podcast is now published daily – Find the latest episode here