It’s a curious set of circumstances. Rents in the capital have never been higher. Mortgage finance, at least for those who went with a tracker during the boom, is at rock-bottom levels.

And yet landlords, if one line of reasoning is followed, are departing the market in large numbers, bringing with them properties that were previously on the rental market, which are now being sold to owner-occupiers.

And if they haven’t left already, they’re thinking about it, on the back of rent controls, higher taxation and greater compliance costs.

But why should this be so?

The costs

The costs associated with being a landlord have been rising steadily since the crash. Back in 2014, for example, DKM Consultants reported that the cost to a landlord of providing private rental accommodation had increased up to 24 per cent, due to the burden of extra taxation, complying with new regulations and local property tax.

An ideal property investment will generate a healthy positive cash flow. However, as the Irish Property Owners’ Association argues, “when one takes account of debt servicing and the substantial tax and charges burden, a buy-to-let investment is not self-financing and requires significant subsidising from other income sources”.

KPMG, in a submission to last year’s review of taxation on rental properties, says: “The financial returns are negligible when compared to the value of the properties and the risks/effort involved”.

The rent controls

A cause of frustration for many landlords has been the introduction of rent controls at the end of 2016; particularly for those who opted not to increase rents because they had good tenants.

With annual rent increases now limited to 2 per cent on existing tenancies, or 4 per cent on new ones, a chasm may have opened up between their property and market rents.

A review by the Department of Finance last year received more than 60 responses from landlords. One said: “I am a small-time landlord. I am one of those who didn’t increase my rent for years. Now I find myself €500 per month below the market rent with each of my two properties,” is one landlord’s view.

Another, who took the same approach, says, “I would have been better-served to increase rents fully in line with market rents as many institutional landlords did, regardless of the impact on my tenants”.

A third fears that, because they kept rents low to reward good tenants, they are now being penalised when it comes to the value of the property.

“The capital value of my property investment is now reduced as no new investor would purchase the property on the rental yield they would be obliged to uphold,” says another landlord.

The tax take

Why this is so is largely down to taxation. The introduction of USC on rental income, the fact that local property tax is not a legitimate deductible expense and reduction in allowable mortgage interest relief (currently being reversed) all conspire to heighten the tax burden.

At a time when countries such as the UK are reducing their tax offsets, the Irish State is going in the opposite direction.

Up to 80 per cent of mortgage interest can now be allowed against rental income, and this is expected to go back to 100 per cent.

However, the increase is not coming fast enough to help landlords. Chartered Accountants Ireland gives an example of a landlord who pays €4,000 in interest during the year. Even with the increase to 80 per cent, the tax savings in 2017 compared with 2016 will be about €100.“This is unlikely to be enough to keep a landlord in the market,” it found.

New landlords

But despite the challenges, the strength of the rental market means many people who steered clear in recent years are once more considering investing in property. Any move needs to be carefully considered. If it is being done with mortgage finance, it’s unlikely to be attractive.

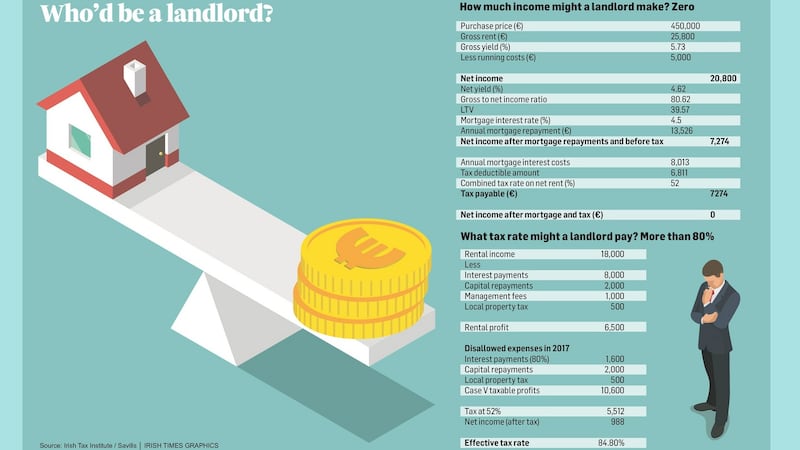

As our first table shows, someone buying a property worth €450,000, with a significant downpayment of €271,935 – and even one generating a gross yield of almost 6 per cent – will still struggle to keep anything in their pocket at the end of the year.

This is largely because the cost of servicing a mortgage at a rate of 4.5 per cent, while also paying tax on rental income at 52 per cent, wipes out any potential gains.

As our example shows, our erstwhile investor is left with a return of precisely zero on their €272,000 investment.

Of course, capital gains are also a possibility but most investors would like a cash-flow analysis before investing. As a comparison, a cash buyer on this property would be walking away with an after-tax return of €10,000 or more.

According to a calculation from the Irish Tax Institute, shown in Table 2, a landlord with a rental income of €18,000, ends up paying tax at a rate of almost 85 per cent – far higher than marginal rates.

Using this calculation in the 15th year of a landlord’s loan, when the interest portion has shrunk, there is an effective tax rate of more than 120 per cent, according to the institute.

Cash buyers

However, it’s important to distinguish between the investor either buying a property with cash, or with no finance outstanding on their properties, and those encumbered with mortgages that are dragging their cash flow into the red.

As one landlord, in consultation with the Department of Finance’s review, wrote: “It’s simple. If you have loans out on the properties, you cannot pay your large tax bill (income tax, USC, PRSI, property tax and so on) and out of what is left over pay for the maintenance of the property and loan repayments. It is now a game for cash buyers only despite the high rents.”

For cash buyers, investing in property is much more attractive. A report from Savills late last year found a discernible increase in cash investors into the market, attracted by capital appreciation and strong rents. “Our analysis suggests that, for every geared investor who leaves the market, a greater number of cash-financed investors come in,” the report found.

This flow of cash buyers means that they continue to account for a significant proportion of all residential transactions. Sixty-one per cent of all rented property, or almost 200,000 properties, are now owned outright by investors, according to Savills.

The solutions

In last year’s review by the Department of Finance, the majority of responses came from individual landlords.

They put forward a number of ideas that, they believe, could make being a landlord more attractive to a wider cohort of investors. These include: Allow a private individual to transfer their own buy-to-let property into their own pension fund. Apply a reduced tax rate (for example, 25 per cent corporation tax rate) to rental income. Abolish the rent-a-room scheme, which allows homeowners earn €14,000 tax free, as it “is simply unfair and distorting the market”. Allow landlords’ time and travel expenses to be offset against tax liabilities. Consider a 100 per cent upfront capital allowances rate being made available in respect of the qualifying cost of fixtures and fittings on newly converted or restored premises that are being placed on the rental market for the first time. Consider the rental business as a business. Remove the close-company surcharge, remove the double layer of capital gains tax and just leave the 25 per cent tax rate if the landlord decides to run his rental business with a limited company, so that he can discount all proper business expenses incurred. Allow so-called “accidental landlord” pay no tax on rental income. Tax on long-term residential leases be limited to the standard rate of income tax, 20 per cent. A reduced rate of capital gains tax for long-term residential rental property

Panel: Who’d be a landlord? Landlords give their views

“I am crucified to the point that I am considering selling up.”

“It currently costs us between €400 - €500 a month to maintain our position as landlord.”

“To add insult to injury, vulture funds pay just €250 a year in tax.”

“We are just propping up the investments from our “disposable” income”

“Please stop calling my income “unearned”. Just try out property management and see!”

“The legislation (rent controls) penalises good landlords for being fair with good tenants. “

“The financial returns are negligible when compared to the value of the properties and the risks / effort involved”

“Anyone considering becoming a buy to let landlord, would need to do the maths honestly...To me, it would appear to be a complete waste of time and money”.

“I am most sorry that I ever considered the rental market not due to bad tenants but due to poor yields and taxation”.

“This year and for the foreseeable future I will have to sell a rental property each year going forward to pay the taxes on the income earned”.

Source: Department of Finance