House prices are rising sharply once more. Latest figures show that property prices are currently increasing at an annual rate of about 8 per cent. This means that a house that sold for €400,000 last year, may now command an additional €32,000 – increasing the cost of home ownership, and making it more difficult for people to buy.

And if asking prices are anything to go by, sustained growth might be on the way. Figures from Daft.ie show that asking prices grew at an annual pace of 6.7 per cent in the second quarter, on the back of shrinking supply.

Unsurprisingly, then, the amounts people are borrowing to fund a property purchase are also on the rise. According to the ESRI, the average loan-to-income ratio – the amount borrowed as a proportion of income – in the Irish mortgage market is now back to multiples “only previously seen at the peak of the Celtic tiger boom”.

As affordability continues to crunch, and supply remains constrained, the numbers buying their own home is also falling. Figures from the Banking & Payments Federation of Ireland (BPFI) show that mortgage drawdowns fell by almost 20 per cent in volume terms in the first quarter of the year.

READ MORE

Nonetheless, despite such heady statistics, people continue to buy their first home; these same statistics show that more than 12,000 first-time buyers drew down a mortgage in the six months to March 2024.

So who are they?

They’re getting older

In 2007 the average age of a first-time buyer was just 29, according to data from the Irish Mortgage Corporation, while the report also found a “slight increase in the number of first-time buyers aged 25-29″. Indeed, figures from the BPFI show that almost two in every three buyers (60 per cent) were younger than 30 back in 2004.

Today, according to Central Bank of Ireland data, the typical first-time buyer is 35 – the highest age on record. Not only that, but almost half of first-time buyers (44 per cent) are older than 35. This represents a sharp increase from 36 per cent in 2019, and just 17 per cent in 2004.

However, although first-time buyers are older than in years gone by, expectations that more people will be paying a mortgage into retirement isn’t reflected in the data. Indeed the BPFI data shows that the median loan term for first-time buyers has been 30 years since at least 2012.

[ First-time buyers looking further afield for homes amid stiff competitionOpens in new window ]

They’re not necessarily in a couple

It’s often considered essential to be in a couple in order to be able to afford to buy a home in Ireland today. However, data on this might surprise.

According to the Central Bank, almost 30 per cent of first-time buyers last year were single buyers – this is down on 2021, however, when 32 per cent of buyers were single.

They’re borrowing more

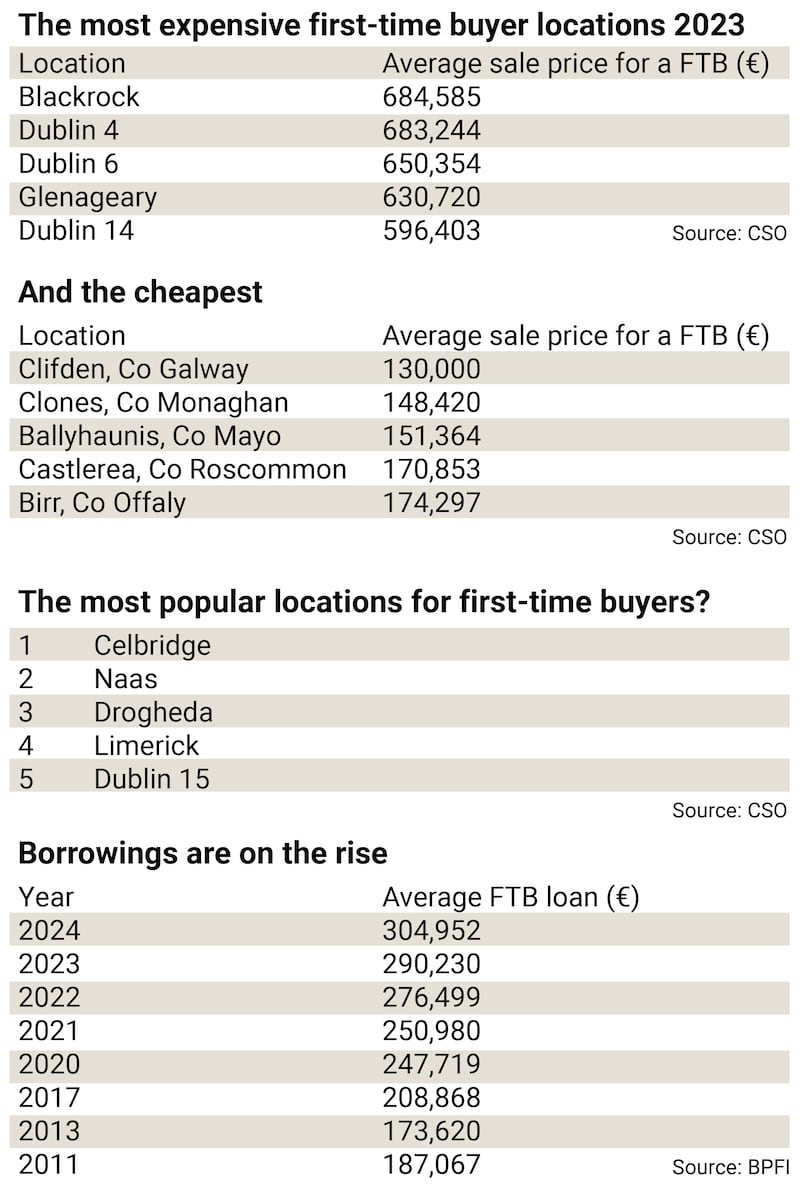

As house prices continue to rise, so too does the amount people need to borrow in order to buy a home. Figures from the BPFI show that the average loan in April of this year was €304,952. This is up from €290,230 a year earlier, and up more than 20 per cent from €247,719 back in 2020.

This depends on the location, of course: the median loan for someone buying a second-hand home in Cork was €239,000; €228,000 in Galway; and €212,000 in Limerick. These have also risen, however, with the Limerick figure up by €16,000 on 2022, for example.

They’re also earning more

Today’s average first-time buyer has an average annual income of some €88,090 (earned either singly or jointly by a couple). This is up by more than €15,000 on the average income in 2018. This income is typically lower outside of Dublin – for example, €67,000 in Limerick for someone buying a second-hand home; €73,000 in Galway; and €75,000 in Cork.

However, earnings may not be rising fast enough to cope with the jump in house prices, which can put more pressure on households. The average loan has jumped 29 per cent from 2018 – while income is only up 22 per cent.

[ How do we go about buying our first home?Opens in new window ]

They have a hefty deposit

Given rising house prices, the amount required as a deposit is also on the rise. Central Bank figures give an average deposit of almost €75,000 for 2023, up from €70,000 a year earlier.

But for those who do buy, getting such a level of cash funding is not proving problematic.

Indeed despite a Central Bank requirement to have just 10 per cent of a deposit (whether it comes from savings, a gift, or the help-to-buy scheme), the average first-time buyer has significantly more than this.

Figures from the Central Bank show that the average loan-to-value – the size of the loan as a proportion of the value of the property – was 80 per cent last year. And this is pretty much exactly the same as 2022, 2021 and 2018.

So what does this tell us?

Well, help-to-buy is likely to be a factor here, as it offers up to €30,000 back on your taxes when buying a new home (and you need to have a minimum loan-to-value of 70 per cent to qualify).

However, it also suggests that family gifts are a big factor for those who do buy – and it would seem that parents are helping to keep LTVs low, even as house prices continue to rise.

This may well be one of the ironies of today’s housing market – those who can buy, and avail of help-to-buy, for example, or gifts from family, have more than enough funds to do so. Otherwise, LTVs would be a lot closer to 90 per cent.

But for those who don’t enjoy such benefits, getting access to the property market is likely to continue to prove very challenging.

They’re buying around Dublin

It may be the most expensive part of the country, but figures show that Dublin, and its surrounding counties, remains the most popular location for buying a home, accounting for almost two out of every three purchases (63.4 per cent) last year.

Three in every 10 first-time buyers bought in Dublin, while less than one in 10 bought in the whole of Connacht.

Other urban areas also report relatively low levels of first-time buyer activity. Properties in Limerick, for example, accounted for just 3.5 per cent of mortgages in 2023, according to BPFI figures, with Galway accounting for just 4.5 per cent.

Their homes are smaller

One interesting aspect to information compiled by the Central Bank is the that the typical home bought by a first-time buyer is shrinking. Indeed back in 2019, the average size of such a home was 1,465sq ft. Last year however, it had fallen by 12.5 per cent to 1,282sq ft. Given the ongoing difficulty in purchasing apartments (only 6 per cent of new apartments in 2023 were bought by households, according to BPFI figures), this suggests that new-build houses are getting smaller.

They like semidetached houses

There seems to be no signs that first-time buyers are giving up on the traditional semidetached house. Figures from the BPFI show that 39 per cent of first-time buyers bought a semi-d last year.

Just 13 per cent of first-time buyers bought apartments, with a further 23 per cent buying a terraced home.

They like self-builds

One-off housing remains hugely popular with first-time buyers. Figures from the BPFI show that more than one in five loans for a new home were for self-builds.

No surprise, perhaps, given how much self-builds dominate the help-to-buy scheme. In the 11 months to November 2023, for example, 29 per cent of total help-to-buy claims came from people building their own homes.

Very few of these are in Dublin, however – self-build loans account for just 4 per cent of mortgages on a new property in the capital.

In Galway on the other hand, some 55 per cent of buyers of new homes are self-builders.

It is likely that, as with deposits, first-time buyers in less urban areas are benefiting from the bank of mum and dad, as they may be gifted family land to build on.

- Sign up for Business push alerts and have the best news, analysis and comment delivered directly to your phone

- Find The Irish Times on WhatsApp and stay up to date

- Our Inside Business podcast is published weekly – Find the latest episode here