It’s just a week away: next Tuesday we will find out just how the Government is set to share any of the recent surpluses collected by the exchequer with us. While many households would like a generous easing of their tax burdens, that is unlikely to happen – particularly if we look at recent experience.

According to an analysis by PwC of how incomes have changed over the past decade, personal tax burdens have certainly fallen. However, at a time when inflation is of the order of about 6 per cent, this doesn’t necessarily mean that Irish households are feeling richer.

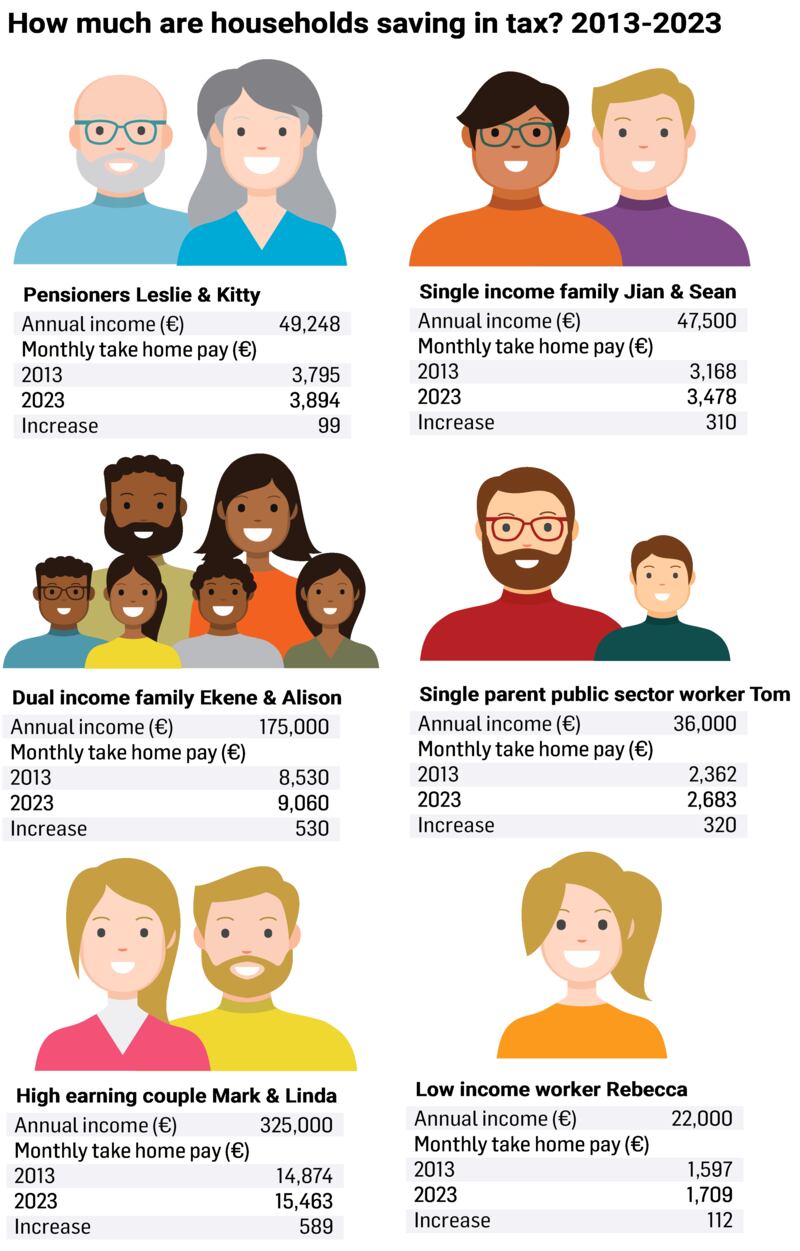

As the analysis shows, a single-income family earning €47,500 is just €310 better off in 2023 than it would have been in 2013.

“But with inflation and increasing costs, these families are certainly not feeling the benefit of that €310 today and they will be looking to the Government to implement the one-off measures they have spoken about to help with the increasing cost of living,” says Katie O’Neill, a director with PwC Private.

READ MORE

So what will change next week?

“We will be looking for one-off measures to help those households that are really feeling the pressure over the coming months, whether this is in the form of once-off social welfare payments, energy credits or other similar measures. Any relief will be greatly welcomed,” she adds.

[ Budget 2024: €65bn in surpluses to be revised down, McGrath signalsOpens in new window ]

Before we find out what the changes are going to be, let’s look back and see how the tax burden on Irish households has changed since the days of austerity back in 2013.

Biggest boon for low- to middle-income workers

So who are the winners of the Government’s budget strategy over the past decade? Well, as our table shows, the biggest fall in tax burden has been for those in the low- to middle-income bracket.

Back in 2013, our single-parent public sector worker Tom lost a fifth, or about 21.3 per cent, of his income on taxes. This year that burden has shrunk to just 10.6 per cent on the same salary, meaning that he gets to keep an extra €320 of his €3,000 monthly wage.

Of course, at the same time, other expenses, such as his rent, have almost certainly risen. For tenants like him, an increase in the €500 rent credit will be hoped for come next Tuesday.

Similarly, our worker on €22,000 also saw a substantial decrease in the amount of tax she pays. Back in 2013, Rebecca only got to keep €1,597 of her €1,833 monthly income. This has since risen by €112 a month, however, or by €1,344 a year.

She will be watching next week’s budget closely to make sure that any increases in her wages next year are not swallowed up by a higher tax burden.

“With increases to minimum wage coming in the budget, it will be important to see indexing of the tax rate bands and credits to ensure that those lower-paid workers are not pushed into the higher tax rate bands,” says O’Neill.

[ Budget call to make childcare fees fully deductible against taxOpens in new window ]

Our typical family, a couple with one income of €47,500 (CSO figures suggest a median income of €46,999 for 2022), Jian and Seán have also seen their tax burden fall quite considerably over the past 10 years. Back in 2013, 20 per cent of their income went on taxes, meaning they got to keep just €3,168 of their €3,958 monthly salary. Fast-forward 10 years, however, and their take-home income has jumped by €310 a month to €3,478, as their tax burden as a percentage of income fell to 12.1 per cent.

Homeowners like this couple may well be hoping for some form of mortgage interest relief to help ease the impact of increasing interest rates, or an increase in the rent-a-room scheme, which allows households to earn up to €14,000 tax-free by renting out a room or rooms in their home.

Widening the tax bands and reducing USC have been the main reasons for the rise in take-home pay over the past decade. Back in 2013, Tom paid €4,372 in income tax a year compared to €1,500 in 2023. When it comes to USC, he paid €1,839 a year in 2013 and less than half of that – €867 – in 2023.

It’s worth noting, however, that while tax on their income has fallen, the purchasing power of that money has also declined. And other payments have not been inflation-adjusted at all. The couple get €280 a month in child benefit for their two children but this figure has remained constant since 2016, the last time the rate was increased. Moreover, the property tax revaluation in November 2021 may have meant higher property tax bills for some.

Pensioners

As was the case back in 2013, our pensioners still have the lowest tax burden of any of our families as a percentage of their income.

Ten years ago, as the State was emerging from the financial crisis, they gave up 7.5 per cent of their income on taxes; since then, it has fallen to 5.1 per cent. This means that our pensioners, who are on annual income of some €49,248 (made up of an occupational pension of €22,000, along with two State contributory pensions and deposit interest) now get to keep an additional €99 a month.

[ Chambers Ireland calls for delivery on infrastructure and housing in Budget 2024Opens in new window ]

While pensioners paid no PRSI back in 2013, they did pay more income tax, and USC, than they do today.

Pensioners have also seen the rate of the State pension rise substantially over the past 10 years, from €230.30 a week in 2013 to €265.30 a week at present. And a further increase is expected next week.

Higher earners

Taxes have also fallen for those on higher incomes; but the reduction, as a percentage of their income, has not been as great as for those on lower and middle incomes, showing how Government policy in recent years has been focused on the more densely populated middle cohort of income earners.

Our dual-income couple, with total earnings of €175,000 a year, gave up 41.5 per cent of their income in taxes in 2013; by this year, that has shrunk to just 37.9 per cent, a reduction of just 9.5 per cent.

Of course in monetary terms, this is still significant, representing an increase in take-home income of €530 a month, or €6,360 a year.

Similarly, our high-earning couple, on annual income of €325,000 a year, also saw the amount of income they give up in tax, as a percentage of their income, fall by just 5 per cent from 2013 to 2023. Again, however, given the size of their overall income, this is still significant at €589 a month.