Nowhere is the Irish boom and bust cycle more evident than in the housing market.

Ireland had the fastest growth in house prices in the run up to the bust, the biggest collapse . . . and now the most rapid recovery.

Welcome to one of the world’s most volatile housing markets.

The pattern suggests the property market is currently set up in favour of the older generation, who typically own their home and is stacked against those looking to buy. For the former group , house price volatility is a dinner party topic, for the latter it is life-changing.

This cycle is becoming exhausting and hugely disruptive for those who view property as a home and not an asset class.

So, are Irish people facing an endless cycle where affordability problems mount as prices surge and then, when the market turns, large numbers find them selves in negative equity, with all the social costs that entails?

To understand why this is happening let us examine the data.

The Data

The figures are stark.

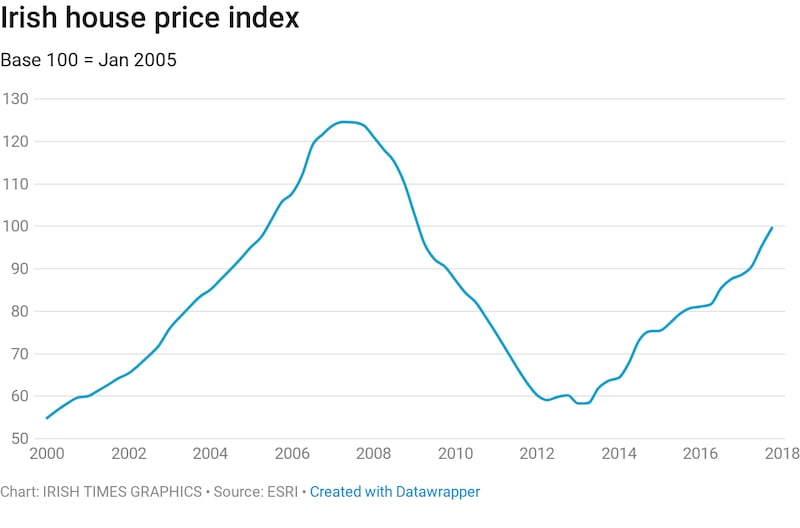

A recent analysis by ESRI research professor Kieran McQuinn, based largely on international data collected by the Dallas Federal Reserve, showed Irish house prices rose by 431 per cent between 1995 and 2007, crashed by 49 per cent up to 2013 and, up to the end of last year have since recovered by 57 per cent.

Comparing us with other major countries gives Ireland the triple crown of volatility – the biggest boom, the worst bust followed by the most dramatic recovery.

A typical house in Ireland might have been worth around €74,000 (or £65,000) in 1995, rising to €319,000 at the peak of the boom, falling to €163,000 at the floor, rising back to €255,000 at the end of last year – and probably heading over €270,000 now.

With property, ebb and flow of prices is normal, but not this much.

The reasons

Why is this happening?

The uniquely volatile nature of the Irish housing market over the past 20 years comes from a number of key factors: the demand for housing, the supply and financing.

McQuinn points to the huge increase in economic activity in the 1990s – generally seen as Ireland “ catching up” with EU living standards – and a rapid period of housebuilding.

During this period rapid development and rising incomes, well ahead of the international average, upped demand and prices followed.

In the early 2000s, after Ireland joined the euro, credit growth started to grow strongly, with banks able to borrow internationally to lend, rather than relying largely on Irish savings.

At the same time interest rates moved generally lower, leading to a flood of cheap finance. As banks battled for market share, normal lending rules were forgotten and borrowers were given way too much finance in relation to their income, or the long-term value of what they were buying.

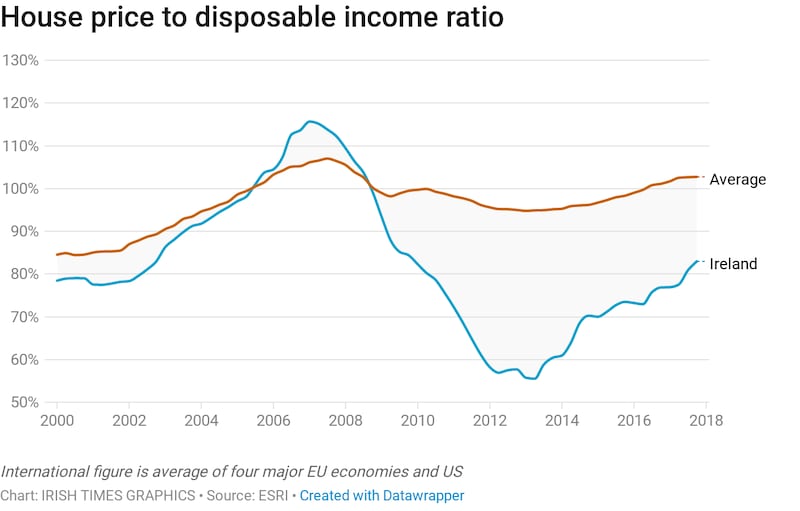

When exactly sustainable house price growth turned into a bubble is debatable, but McQuinn’s analysis shows that by 2005 prices here were starting to look frothy in relation to incomes.

Government policy

Government tax incentives added further froth to demand – and in many cases led to houses being built in areas where there is now little demand.

TCD economist and property expert Ronan Lyons points to another factor – Ireland's extraordinarily open labour market.

During the boom, and following the entry of Eastern European countries into the EU, tens of thousands came to Ireland for work,along with the return of many Irish people who had previously left, many in the 1980s.

During the bust, many went home and Irish people again started to leave, a trend now reversing.

This is a huge swing factor in housing demand and one reason why the Irish market is unusually volatile.

McQuinn and Lyons also point to fundamental issues on Irish housing supply, which collapsed in the bust and has been slow to respond to the upturn.

McQuinn believes the inflexible supply of land onto the Irish market – partly due to land hoarding as prices rise, partly due to planning and servicing – was key.

Lyons argues new rules and regulations in some areas has now made it difficult for construction to build in response to demand.

The problem in the boom, he argues, was not a lack of regulations but the fact many were not enforced. Whatever the reasons, supply has been very slow to respond to the upturn.

What happens next?

Breaking the cycle of house price volatility is no easy task. Are we near the top of the current house price cycle? If the economy keeps going and a hard Brexit is avoided next year, many forecasters believe prices can keep rising for a while yet.

But there are uncertainties, too, and the era of super low interest rates will end, with the first ECB increase likely towards the end of next year.

McQuinn’s analysis suggests that at the end of last year, house prices were still not overvalued here in relation to income.

However, prices have increased more strongly in Dublin since the crash and in some areas are now back not far off peak levels.

Also, according to McQuinn, there are signs the Central Bank rules, restricting borrowing to 3.5 times income, are now starting to have an impact and are slowing price growth at the top end of the market.

More and more people are hitting their borrowing limit, certainly in the more in-demand parts of the Dublin market and some of the other major cities.

But in turn this is pushing up demand elsewhere as these buyers look to different areas.

Role of property funds

And there is another factor in the Irish property market supporting demand – investment from property funds and trusts buying up apartments and some housing for rental and, they hope, capital appreciation.

This has helped to push prices higher, quicker, with CSO figures showing investors are now responsible for one in five house purchases.

While supply is starting to pick up, it continues – for the moment – to lag behind what is needed, and so prices in many areas are likely to keep rising, with many buyers now forced to move to the second, or third or lower choice of location.

The Government is trying to move on increasing supply, promising investment and denser development in city centres. McQuinn says the proposed hike in the vacant site levy could be important in combatting land hoarding – though the property industry does not agree.

Lyons points to the huge availability of State-owned land – in army barracks, bus depots and so on, that could be targeted for development.

The future

The bottom line is that solving this supply conundrum is complicated and will take time.

We also have to hope that demand is kept in check and new borrowers are not overly exposed when prices do turn down.

And the presence of international finance and investments funds as a big player in the market brings another layer of unpredictability.

Will these investors seek to cash in when interest rates rise and prices start to ease, throwing large amounts of properties onto the market?

They have flooded into Ireland looking for returns in an era where these are hard to find elsewhere, but this may change, and suddenly.

Breaking Ireland’s boom and bust economic cycle means ending the property price rollercoaster.

Ideally, Irish property prices would still go up and down, but less dramatically.

To achieve this the Central Bank has a key regulatory role to play here in terms of the rules it sets and how they are enforced.

The real question is whether the Irish political and public mindset can also help deliver this.

The Smart Money is new weekly column that seeks to explain the economic forces shaping many areas of our lives, from property, to education, the labour market and personal finance. If there is an issue you would like to see Cliff Taylor examine aspart of this series please email feedback@irishtimes.com