I’m well aware that on the spectrum of interesting things, sex is at one end and pensions at the other. But since I reach pensionable age this week, I have become very interested indeed in the most boring of subjects. And I have been struck by the way the State seems to have no idea what it’s doing. It has just adopted two big policy measures that directly contradict each other.

Everybody knows that people are living longer and that the Irish population as a whole is ageing. Those of us who have managed to get to 65 can now expect to live for another 20 years. This is great news, at least for us. When I tick the box that says Age: 65 – I hope that little dash is elongated to infinity and beyond.

But this also means that the State has to pay out old age pensions for many more years to many more people. This is not currently a big problem. Our population is relatively young and so the cost of public pension spending as a proportion of GDP is still less than half that of the average of developed OECD countries.

But this will change. The ratio of people over 65 to the rest of the adult population will hit 28 per cent in 2031, 34 per cent in 2041 and 41 per cent in 2051. If your job is to think about the long-term future of the public finances, this should give you grey hairs.

READ MORE

The last government tried to plan for this big shift by proposing to increase the age at which people qualify for the State pension to 67 in 2021 and 68 in 2028. After an uproar, it backed down and compromised on 66.

But it is also trying to do something else – incentivise us 66 year-olds to put off taking our State pensions for a few years. It has just brought in a new system of pension payments: the longer I put off drawing down my pension, the higher my weekly payment will be. So if I take the pension now, I get €277 a week, but if I leave it another year, it’s €290 and so on up to €337 if I wait until I’m 70.

This is all good. It gives us choices that might suit our individual circumstances. Some people just need the money now to live on. But some people may want to continue in their jobs for a few years, or they may, like me, be leaving their day jobs but have the capacity to keep earning money in other ways.

So far, so sensible. Except that at exactly the same time as the State is bringing in this new scheme, it’s also making another big change relating to how it treats retirement income. And, almost unbelievably, its effect is completely to negate the incentive to postpone the State pension.

This other change has to do with PRSI. Up to now, those aged 66 and over were exempt from paying PRSI on their incomes. The State has just increased this cut-off point to 70. So someone like me who has a private pension and continuing work income will keep paying full PRSI for another four years.

I have absolutely no problem with this. There’s no just reason why I should be exempted from what is, in effect, a tax on my income while someone who is 40 with a mortgage and young kids, and perhaps less money than I have, has to pay it.

But here’s the mad bit. There is still a way to avoid paying PRSI if you’re over 66. Breathtakingly, that get-out-of-PRSI-free card is to take your State pension. If you don’t take your State pension at 66, you pay full PRSI on all your income. If you do take it, you pay none.

PRSI is charged at 4 per cent of that income. So let’s say I manage to earn €60,000 in the year after I retire. If I take my State pension, I avoid PRSI payments of €2,400. Essentially, the State is bribing me with €2,400 a year not to do what the State actually wants me to do, which is to postpone the drawdown of my public pension. There’s a concept economists call a “perverse incentive”. This one should be in the textbooks.

As Fiona Reddan pointed out in The Irish Times recently, “the ‘cost’ of staying in the workforce [until 70], (taking into account State pension forgone plus PRSI payments) comes to some €62,600 for someone earning €30,000, rising to €74,080 for someone with a gross salary of €100,000.” Who’s going to accept those costs when you can avoid them just by drawing down your State pension at 66?

But it’s actually even more bizarre than this. PRSI is also paid by employers. The State wants to encourage those employers to keep people working, earning and paying tax beyond the age of 66. But now it’s saying that if they do that, they will have to pay 11 per cent of that older employee’s wages in PRSI.

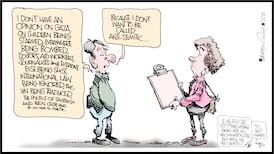

What we have here is the Department of Social Protection bringing in one new policy and the Department of Finance bringing in another – and the two policies cancelling each other out. How on earth can this happen? What kind of governing process produces at the same time a measure to encourage citizens to do one thing and another measure to encourage them to do the opposite?

[ Can my wife get a widow’s pension alongside the old age pension when I die?Opens in new window ]

Only one that operates in silos – and one that has little sense of the real-life consequences of policy changes. We can see here one set of civil servants working away in one part of town on one strategy and another elsewhere sweating over a different scheme. They both mean well but apparently never talk to each other. And their political bosses don’t seem to notice that the plans are mutually self-sabotaging. If you think too much about this dysfunction it would put years on you.