“A lot of red on the screen” was how traders summarised the market performance on Friday as global news hit markets.

European stocks took serious damage heading into the weekend as US president Donald Trump threatened to hit China with more trade tariffs, escalating a bruising and protracted clash between the world's two biggest economies. China said on Friday it would take countermeasures.

Dublin

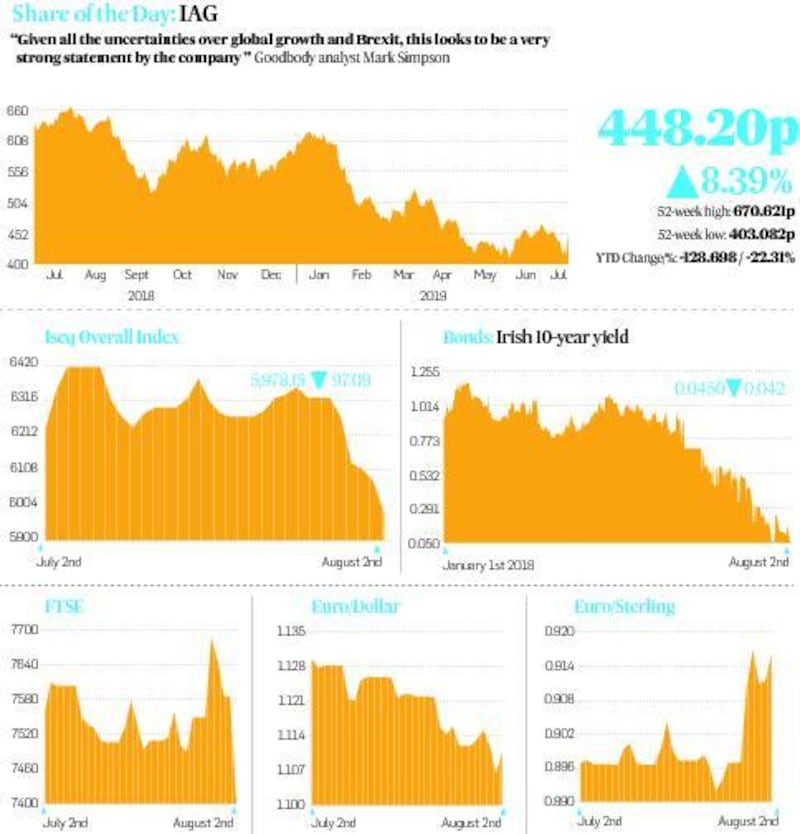

The Iseq fell 1.6 per cent over the day, dragged lower by airlines, building and paper stocks to close at 5,978.

Ryanair continued to tick lower, declining 1.9 per cent to €9.42, as the company continued to battle bad news about the potential loss of up to 900 jobs at the airline. On Friday, European regulators ordered France to recover €8.5 million from Ryanair at Montpellier airport, saying it was "illegal aid" that gave the carrier an unfair advantage.

CRH was down 4.2 per cent to €28.75, tracking a decline in other cement stocks, while in paper stocks, Smurfit was down 2.5 per cent to €27.56, in line with its European peers.

Glanbia provided a bright spot in the market, recovering 7.4 per cent over the session to end at €11.63. However, traders noted the stock had taken a hammering in the previous two days, losing 8 per cent on Thursday and 15 per cent on Wednesday following its profit warning. The bounce in the price was generally seen as encouraging though.

London

UK shares plunged to their lowest in a more than a month on Friday after US president Donald Trump threatened more tariffs on China while a Brexit-induced warning on targets knocked shares in Royal Bank of Scotland.

The FTSE 100 index slumped 2.3 per cent on its worst day so far this year, while the FTSE 250 midcap index weakened by 1.7 per cent.

All of the major constituent sectors on both indexes ended with losses for the day. Asia-focused bank stocks, including HSBC, and oil majors Shell and BP led losses on the main index.

British Airways owner IAG, however, jumped 8.4 per cent – its biggest one-day gain in eight years – after reporting strong profit numbers for the first half of its key summer period.

The last major escalation of the US-China trade tensions was behind a sharp drop in the FTSE 100 in May, but the index is still on course for its biggest annual rise since 2016 as Brexit-driven weakness in sterling helps the index’s largely internationally focused companies.

"Anyone trying to determine the next move in stock markets in the last 24 hours would be justified in feeling like they've just experienced a bit of whiplash," said CMC Markets analyst Michael Hewson.

Europe

The European markets posted huge declines after president Trump’s announcement, with both the French and German markets sliding deep into the red.

The pan-European Stoxx 600 index lost 2.46 per cent and MSCI's gauge of stocks across the globe shed 1.27 per cent. Emerging market stocks lost 2.11 per cent. MSCI's broadest index of Asia-Pacific shares outside Japan closed 1.9 per cent lower, while Japan's Nikkei lost 2.11 per cent.

New York

US stocks tumbled to a one-month low on Friday after the sharp escalation in US-China trade tensions and a tepid July jobs report renewed fears of slowing economic growth and raised bets of further interest rate cuts this year.

President Donald Trump on Thursday threatened to slap a 10 per cent tariff on $300 billion of Chinese imports from next month, sending global markets tumbling and investors fleeing to safe-havens like US Treasuries and the Japanese yen. China on Friday said it would not be blackmailed and warned of retaliation.

Technology companies, which get a sizeable portion of their revenue from China, were the hardest hit, down 1.88 per cent, weighed by iPhone maker Apple and chipmakers. Apple is seen as being particularly vulnerable to US trade tensions with China.

The Philadelphia Semiconductor index slipped 1.61 per cent, while shares of Apple fell 2.4 per cent.

By mid-morning, the Dow Jones Industrial Average was down 201.88 points, or 0.76 per cent, at 26,381.54, the S&P 500 was down 26.02 points, or 0.88 per cent, at 2,927.54. The Nasdaq Composite was down 117.00 points, or 1.44 per cent, at 7,994.12.

The S&P 500 slipped below its 50-day moving average, a closely watched indicator of short-term momentum, during the session. The defensive real estate, utilities, and consumer staples sectors were the only S&P sectors trading higher. – Additional reporting: Reuters, Bloomberg