Ireland’s multinational sector is still going strong.

That was one key message from this week’s exchequer figures, which showed a surprise jump in corporation tax in November, following three successive monthly drops.

But there are also signs in the figures and elsewhere of slowing growth in the rest of the economy – the price of the cost-of-living crisis and higher interest rates and also of an economy which in many areas is at capacity.

In other words, the old story of Ireland’s two-tier economy is alive and well. It seems strange, after such strong corporate tax figures, to talk about a slowing economy, but trying to interpret Irish economic data is always a challenge.

READ MORE

The multinational bounce

The only way to make sense of the latest figures is to figure that the decline in corporate tax in the previous three months was due almost entirely to once-off factors in a couple of big companies.

Tax payment times for big companies suggest that the August fall-off reflected a lower payment by Apple – partly due to structural changes by the company – while October’s fall was due to a decline in tax paid by Pfizer, which suffered a fall-off in revenues after a big vaccine-related boost during Covid-19.

However, tax accountants had reckoned that the profitability pressures in some of the other big players – notably in the pharma sector – would be reflected in similar trends in November. The best-case scenario, it was thought, was that the figure would be close to last year’s November monthly total of €5 billion.

November is a key month for corporation tax -most companies make their two big payments in that month and in June.

In the event, it shot up to €6.3 billion. The fact that a significant number of big players made their final tax payments in November means it is hard to know which companies were responsible.

But some big tech players continues to do well. For example, strong recent global results from Microsoft – one of the big five taxpayers – would suggest their payments in Ireland may have risen further. And in general, tech profits have rebounded following the retrenchment of the sector last year.

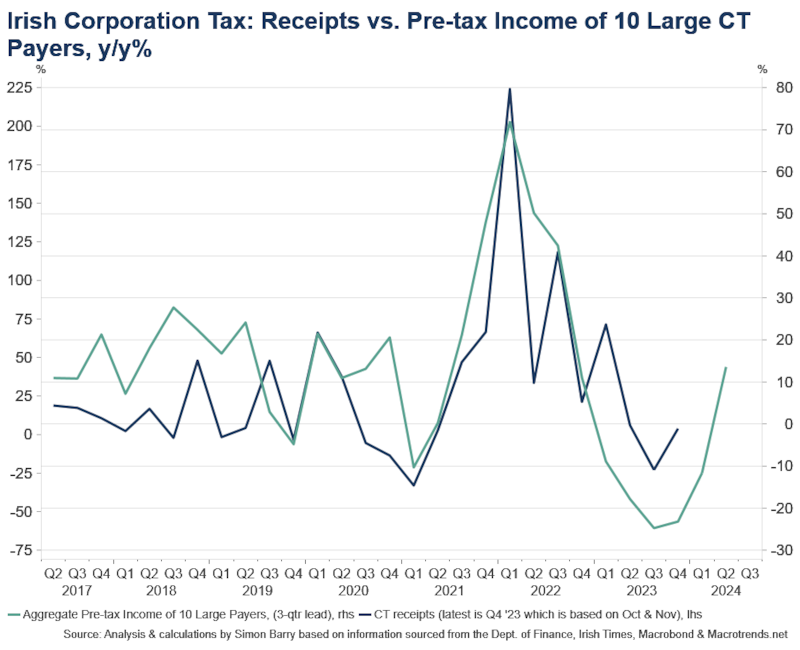

Overall, looking at the profits for big companies based here – those thought to be among the big 10 top taxpayers, economist Simon Barry said the figures showed a recovery in recent months after a post-Covid stall, or a drop in the case of some big pharma companies such as Pfizer, where sales and profits had soared during the pandemic.

While the companies pay tax in Ireland only on a portion of these profits, it is still a reasonable indicator. Tech and pharma have both had their challenges but recent trends look a bit better. And it may also be the case that tax allowances which protected significant portions of international profits of companies moving through their Irish operations from being taxed are started to run down. This means a higher proportion of their profits becoming taxable.

[ Economy entering period of slower growth, Ibec warnsOpens in new window ]

November is a key month for corporation tax – most companies make their two big payments in that month and in June. So this is an encouraging sign of the “resilience” of Irish corporate tax moving into 2024, according to Barry, notwithstanding the ongoing risks of relying on a small number of companies for a lot of tax.

It is also worth noting that while corporate tax this year may now come in close to or at the €23.5 billion target, it is not again outperforming, as had been the case since 2015. And it is the continuing excess of corporation tax that has given the exchequer such room for manoeuvre in recent years.

This period of annual outperformance may now be replaced by more volatility. The fortunes of a few companies – Microsoft, Pfizer, Apple and a few more – will remain vital. Some years these companies will do well, and we must hope they remain on an upward trend – but some years they will do badly.

There are other questions too. In terms of the Organisation for Economic Co-operation and Development (OECD) BEPS process – the corporate tax reform plan – the Republic will gain from the introduction of a new 15 per cent corporate tax rate (though this won’t benefit the Irish exchequer for a few years) but may lose if the second part of the plan is implemented, which will move the right to tax a portion of income away from the State.

And there will always be questions about the way big companies structure themselves, where they locate their intellectual property and how they pay their tax.

What the latest corporation tax bonanza means for the economy

With Cliff Taylor. Presented by Bernice Harrison.

Who knows, for example, what tax changes a second Trump presidency – were that to happen – might bring? Or a move by a returned Joe Biden to deliver on promises he made before the last election to bring more US pharma investment back to America?

You could spend the day speculating here – but the point is that relying on a small number of companies in a small number of sectors inevitably brings risks.

The domestic economy

While multinational-land has bounced – for now anyway – the signs of slowdown in the domestic economy are growing. This is little surprise given the punishing increase in interest rates and the impact of this on mortgage holders, and the wider cost-of-living crisis.

The clearest sign here was the fact that VAT was up 1.4 per cent in November compared with the same month in 2022, a big fall on the rates of increase seen earlier this year. This is partly due to the easing of the inflation rate – an increase in prices of goods and services yields more to the exchequer.

But it also clearly shows a slowdown in the growth rate of consumer spending, as households cut discretionary spending. The retail sales figures for October were essentially flat year on year.

After extraordinary growth which has seen 350,000 jobs added to the national total since 2019, the Irish economy appears to be returning to earth

The post-Covid bounce in spending appears to be well and truly over. Christmas spending will be interesting to watch – households will welcome the fall in energy prices and the prospect of 2024 declines in interest rates. But for now, prices, while not rising so much, remain high and the impact of previous European Central Bank (ECB) interest rate rises is still feeding through.

The jobs market, meanwhile, looks likely to be an ongoing support for the economy, with a decent 5.7 per cent rise in the income tax take in November. But here, too, Barry sees signs that jobs growth looks to be topping out and that this is leading to a moderation in income tax growth.

The unemployment rate remains low at 4.8 per cent – and much of the economy is still stuck with labour shortages – but hiring in many sectors seems to be slowing, against the backdrop of slowing consumer spending and a stuttering and nervous international economy.

In his latest quarterly outlook, Irish Business and Employers Confederation (Ibec) chief economist Gerard Brady writes that Ireland is now “entering a period of slower growth and business consolidation following a period of unprecedented expansion for the Irish export base and labour market”.

After extraordinary growth which has seen 350,000 jobs added to the national total since 2019, the Irish economy appears to be returning to earth. To back up its case, Ibec points to the fall of 6 per cent in goods exports so far this year – reflecting mixed international markets – and a 4 per cent fall in investment in the economy.

Talk of slowing growth may seem counterintuitive at a time when corporate tax receipts have jumped again. But Ireland’s two economies, while linked, have often moved on separate tracks.

The November receipts reflect the fortunes of big tech and pharma companies around the world, rather than what is happening in Ireland.

The latest data does give some confidence about their Irish operations, too. But despite this, the signs are that economic growth is slowing going into 2024. It is not, as the GDP figures would suggest, a recession. But the economic bounce after Covid is done.