The good news first: families across Ireland are paying less tax now than they were 10 years ago. The bad news, however, is that even if next week’s budget delivers a further easing in their tax burden, the sharp rise in the cost of living means that any announcements come September 27th will be unlikely to deliver as much relief as people would like.

As Katie O’Neill, a senior manager with PwC, notes, the public will be seeking more from Budget 2023 to help with the increasing pressure on households and businesses due to rising energy prices and the cost-of-living crisis.

“This may come in the form of income reliefs and targeted measures to provide credits for people living in rented accommodation,” she says.

While we won’t know what exactly is in the mix until next Tuesday, it’s timely to consider just how the personal tax burden has changed in recent years. So what can we learn about income taxes over the past 10 years?

READ MORE

Incomes are rising

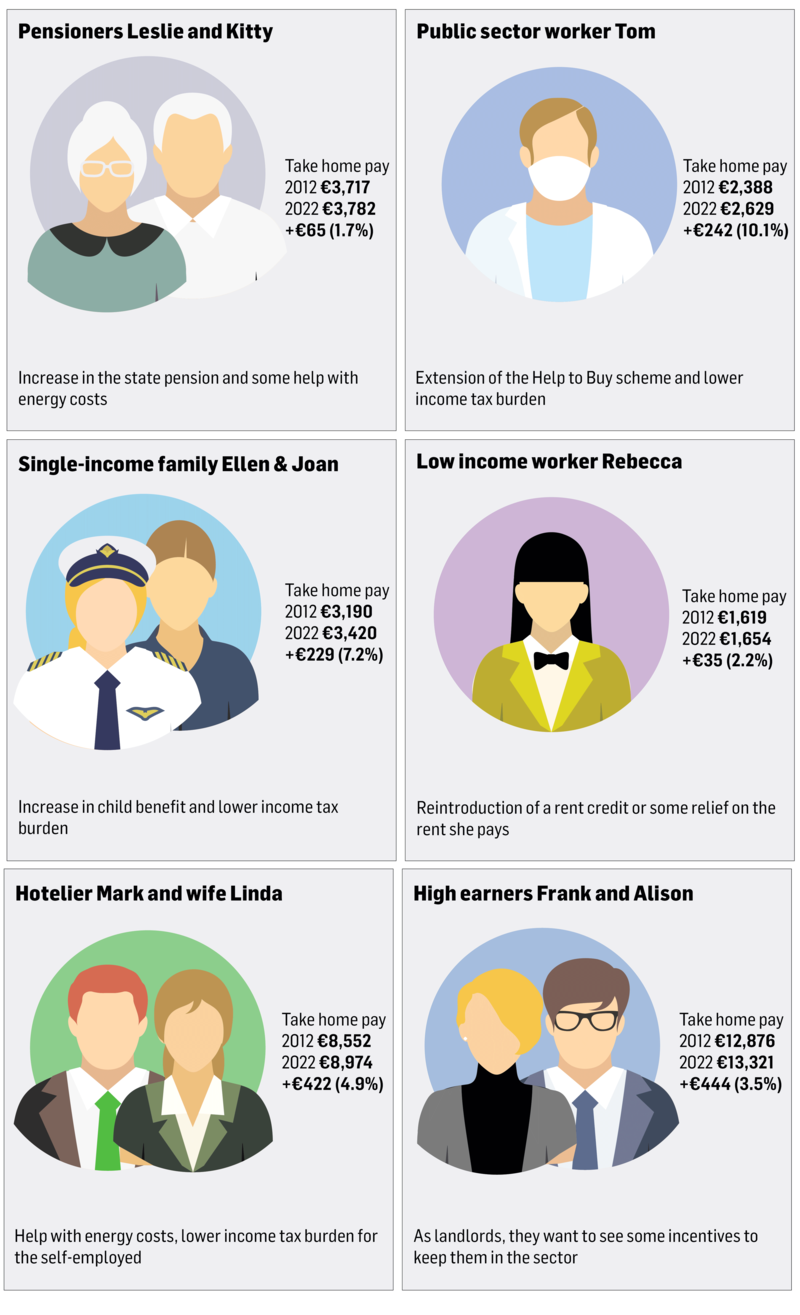

The cumulative impact of a softening in the personal tax burden in recent years means that all our families are now bringing home more money each month than they were a decade ago, at least before you factor in inflation. Even though inflation has been muted for much of that period, in real terms, only two of our six families is better off over the period.

While PRSI has increased over the period, the universal social charge (USC) has been reduced substantially in successive budgets over the same time.

Consider Rebecca, our low-income worker on €22,000. Back in 2012, her monthly take-home pay was €1,619 — today it’s €1,654, so over the past 10 years she has managed to get the grand total of an extra €35 in after-tax income. The bad news for Rebecca is that the real value of that pay cheque is now lower than it was back then.

Part of the reason for relatively small face-value increase is the fact that she now pays more in PRSI (€880 a year compared to €616 back in 2012).

However, her income tax has fallen by €100 a year, due to the increase in the personal tax credit and the PAYE tax credit in last year’s budget, says O’Neill. But the biggest decline is in USC — she now pays €582 less a year on this tax.

Our pensioner couple have also seen a boost to their take-home pay. They now pay €65 less a month in tax than they did back in 2012, thanks to a reduction in both USC and income tax. As they don’t pay PRSI, this has not impacted their income.

Tax savings are capped to some extent, however.

Our dual income couple earning €175,000 now get to keep an extra €422 a month; however, our couple with earnings of €275,000, or €100,000 more, only get to keep €22 extra a month over that sum, coming out with an extra €444.

When it comes to how much families have saved as a percentage of income, the results are somewhat different.

The biggest winner here is the single parent, Tom, on an income of €36,000. He brings home €242 more a month today, than he would have done on the same salary 10 years ago, or an increase of 10 per cent.

This compares with Rebecca on an income of €22,000. She has seen her take-home pay increase by just 2.2 per cent over the same period, less than our high earners on €275,000, who now have an extra 3.5 per cent to spend when they get paid.

The lowest increase, however, is for our married pensioners, whose after tax income only rose by 1.7 per cent over the period, well below the rate of inflation over the period.

The highest tax rates

But who’s giving up most, as a proportion of their income, in tax?

Well, the progressive nature of Ireland’s income tax regime is clearly shown in our table above, which highlights that our worker on the lowest income, of €22,000, has one of the lowest effective tax rates at 9.8 per cent. This compares with a rate of 13.6 per cent for our middle income earners on €47,500.

The person with the lowest income does not pay the lowest rate of tax, however; this honour goes to our pensioner couple, on joint income of €48,000. Thanks to an exemption from PRSI and other benefits, this couple only pay an effective rate of 5.5 per cent, which means they lose just €218 from their €4,000 income each month in tax.

At the other end, the burden increases significantly for those on higher incomes. The dual income couple on €175,000 lose 38.5 per cent of their income in tax, while the couple on €275,000 have an effective tax rate of 42 per cent. This means that they pay almost €10,000 in tax every month.

As with take-home income, Tom, our single parent on €36,000, has seen the most dramatic narrowing in his effective tax rate, down by almost 40 per cent from 2012. Back then, he gave up a fifth of his income in taxes — now it’s just 12.4 per cent.

At the top end, our high earners have seen the smallest reduction in their effective tax rate: our self-employed couple on €175,000 saw a reduction of 7 per cent in their effective tax rate, while the couple on €275,000 have benefited from a reduction of just 4.4 per cent.

Of course, regardless of who has benefited over the last decade, families will be hoping the tax burden will fall further come January 1st, 2023.

“With the increasing cost of living due to inflation, and potential wage price inflation as a result, indexing the tax rate bands and credits would be welcome to ensure that inflation-related increases don’t push lower paid workers into higher tax bands,” says O’Neill.

Not all good news

While overall, after-tax incomes are back to pre-austerity times, the introduction — or stagnation — of other measures mean the benefits may not be as great as initially appear.

Take child benefit. Budget 2012 increased this by €5 to €140 — however, it hasn’t shifted since.

Moreover, the introduction of the local property tax has added an extra burden to homeowners across the State.

Consider our pensioner couple. Their annual income tax burden is €2,616. But they must pay an additional €435 in property tax on their home, which is a hefty extra considering their overall tax burden. The landlord couple pay a combined €1,941 in property taxes for their properties — and remember, property tax isn’t deductible against tax on a rental investment.

Rising energy prices may wipe out many of the benefits of the upcoming budget this winter, particularly if the Government doesn’t look to enhance work-from-home benefits.

“With the increasing costs of electricity and heat, any of our profiled taxpayers who work from home on a regular basis will be interested to see if there will be any enhancements to the current tax arrangements for claiming a deduction for electricity and heating costs,” says O’Neill.

Current benefits mean you might get back about €100 on your annual energy costs through the remote-working relief. When you consider that the average electricity bill is expected to reach €2,000 this year, or €166 a month — and may be a multiple of that over the winter period — the current tax relief scheme would look to be not fit for purpose.

What Budget families want this year

Pensioners Leslie and Kitty

Increase in the state pension and some help with energy costs

Public sector worker Tom

Extension of the Help to Buy scheme and lower income tax burden

Low income worker Rebecca

Reintroduction of a rent credit or some relief on the rent she pays

Single-income family Ellen & Joan

Increase in child benefit and lower income tax burden

Hotelier Mark and wife Linda

Help with energy costs, lower income tax burden for the self-employed

High earners Frank and Alison

As landlords, they want to see some incentives to keep them in the sector