The failure of Silicon Valley Bank (SVB) will surely prove to be a technology industry inflection point, but it may be a long time before we see to what end.

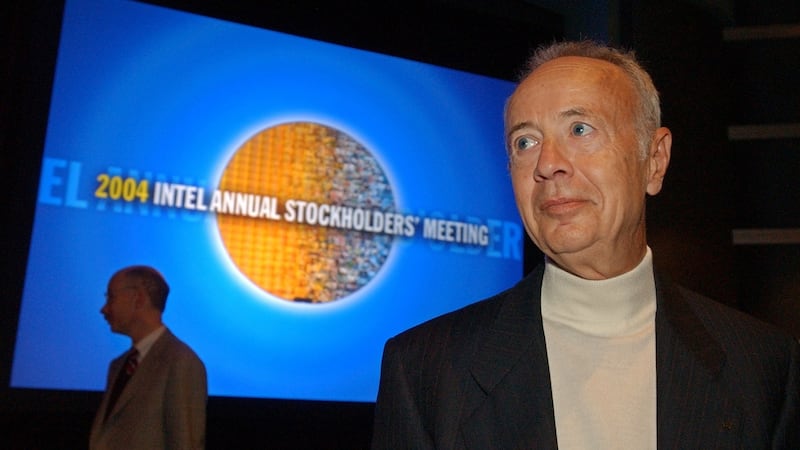

Intel’s third chief executive officer, Andy Grove, placed this borrowed mathematical term firmly in the tech industry lexicon in his 1996 book Only the Paranoid Survive. He wrote that “a strategic inflection point is a time in the life of business when its fundamentals are about to change. That change can mean an opportunity to rise to new heights. But it may just as likely signal the beginning of the end.”

Grove articulated an idea that is now deeply rooted in Valley culture, plus a corollary: such fundamentals alter due to the disruptive innovations brought about by the tech industry itself. So, Silicon Valley celebrates inflection points. One of its raisons d’être is to create them.

The technology industry knows that its disruptive, transformative innovations are big drivers of the altered “fundamentals” that force inflection points for companies, industries, societies. Break things, let others make them anew.

READ MORE

However, the shocking collapse of the firm that provided the banking infrastructure behind so much of the tech sector is such a reckoning point, obviously for now-defunct SVB, but it should reverberate across the Valley and beyond. The bank’s own unfortunate final inflection point is clear.

[ Silicon Valley Bank shows there are few libertarians in a financial foxholeOpens in new window ]

It failed dismally to foresee what many economists had forewarned, that the emergence from lockdowns, manufacturing shutdowns and other pandemic-led constricted economic conditions would be likely to result in rebound inflation, which governments counter by raising interest rates.

The bank’s executive and board made a nearsighted bet that economic conditions would remain the same (a classic Silicon Valley exceptionalist myopia) and, incredibly, tied up three-fourths of its considerable assets in long-term government bonds, with disastrous knock-on effects.

The fallout continues, affecting not just the bank but thousands of companies, many of them start-ups reliant on banked venture funding and without adequate income to cover basics such as payroll.

The situation is disastrous, triggering broader worries about the security of a middle tier of smaller banks that, like the tech industry generally, has incessantly lobbied for greater freedoms, less regulation and thus fewer protections for clients.

Except when that threatens to break the tech industry. Then, all that libertarian hectoring for smaller government, for less government intervention, for hands-off of companies and a sector that innovates and invents, unlike the boring old public sector – all that is muted.

Silicon Valley Bank: what is the cost of the collapse?

On cue, across Twitter (owned by a billionaire with other companies that benefited from government rescue funding), the very industry figures known for decrying government-involved-anything demanded US president Joe Biden and national agencies intervene, guarantee deposits and place a sturdier, government-constructed floor under the collapse. Which happened.

In the irony-free, truth-distorting zone that is the tech sector, vilifying government interventions but demanding such help when (even, stupid) risk goes wrong is the norm. Don’t ever be persuaded otherwise.

As many have pointed out since SVB’s fall, tech companies regularly lobby for US government supports, subsidies and emergency interventions. A drily amusing read comes from the San Francisco Chronicle, an appalling, glorious “Socialism for the rich; capitalism for the rest” list of the big-money tech libertarian voices (many of whom have taken federal subsidies) that clamoured for federal interventions for SVB – even though some helped drive SVB’s collapse by pulling out their own funds.

Add to the mix that there probably isn’t a tech company anywhere that hasn’t directly or indirectly profited from government-funded research across a wide arc of tech-inflected sectors: engineering, electronics, space and aeronautics, medicine, genomics.

Today’s digital-economy companies depend on the US-government-funded internet. Without Big Government investment, they would be scrambling in some narrow, private gatekeeper-controlled alternative online universe that thankfully did not happen.

[ Martin Wolf: Banks are designed to fail – and they doOpens in new window ]

Let’s also clock that SVB’s biggest clients, wealthy individuals and big name venture funds, stuck their money into SVB, and some sat on its board and oversaw its operations.

These are the very people who are supposed to be supremos at vetting entrepreneurs and companies, building boards, selecting capable executives and assessing business fundamentals. Yet they all apparently missed the lack of adequate risk management. In a bank. On which much of a critical sector, including their own portfolio companies, relied.

SVB’s collapse pulls back the curtain on the ridiculous hypocrisies and false narratives beloved of the tech sector, from the supposed all-knowingness of VCs to the myth of rugged entrepreneurial and corporate individualism ... until a bailout is needed.

If the sector is wise, it will attempt to learn from this inflection point. SVB’s demise is both a symptom and obvious outcome of the poorly managed, self-inflicted churn and turmoil across the tech sector, inextricably linked to the sector’s belief in its own exceptionalism.

For too long, it has clung to the idea that the second half of Grove’s inflection point definition – “it may just as likely signal the beginning of the end” – only applied to everyone else.

[ Q+A: Will the US banking crisis reach Irish shores?Opens in new window ]