The majority of local authorities have voted to keep the level of local property tax at the same rate for the coming year.

Only a small number of county and city councils have decided to vary the amount of tax households would pay in their area.

At the moment, LPT is charged at 0.18 per cent of the price of a house up to €1 million and 0.25 per cent on the amount more than €1 million.

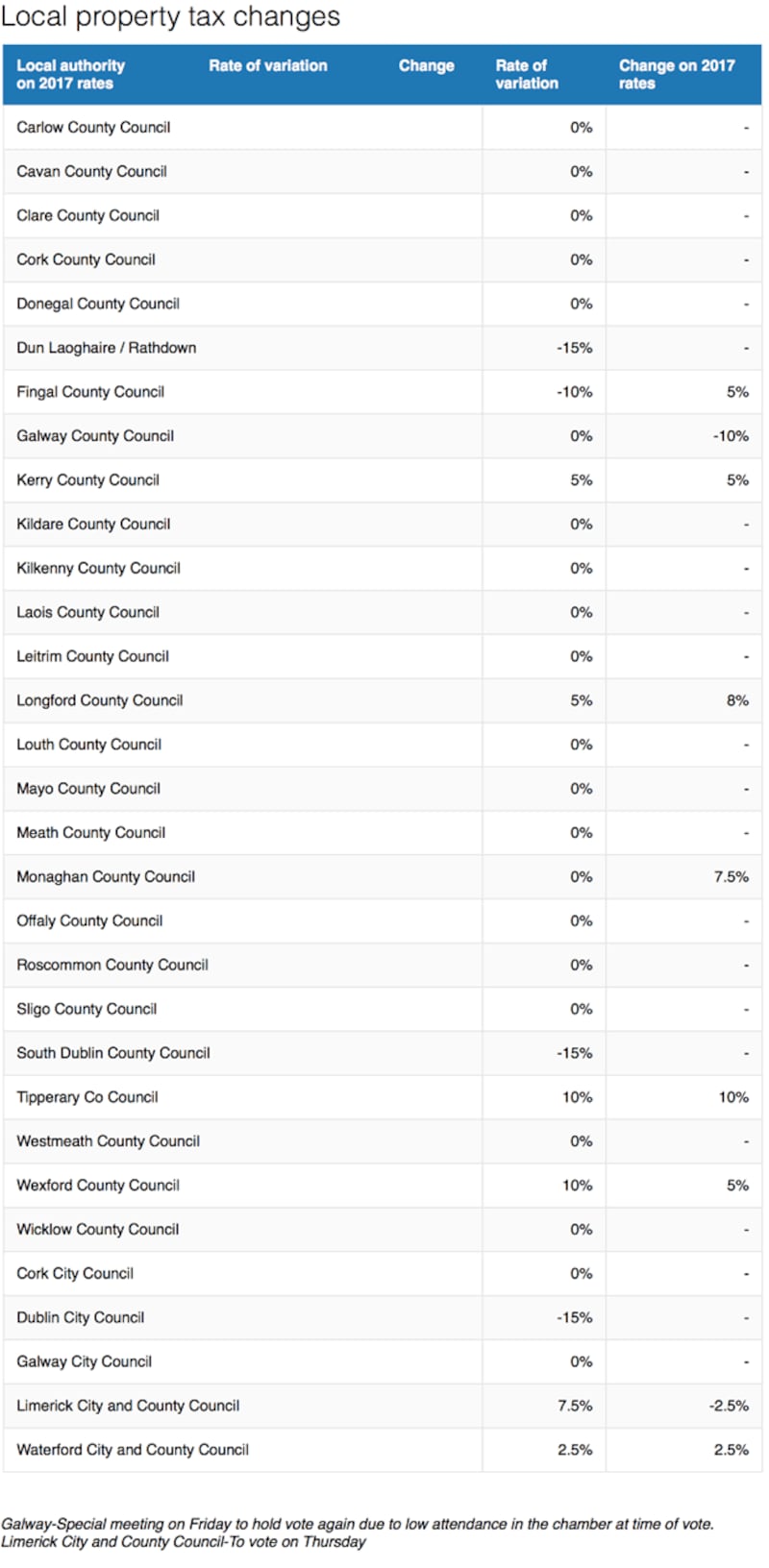

Here is the full list of LPT changes for every local authority around the State for 2018.

Every year councillors vote on whether to apply increase or decrease the local property tax (LPT) between plus or minus 15 per cent of the baseline rate.

Fingal councillors voted to increase their property tax intake by 5 per cent, as the council was set to run a budget shortfall of €8 million.

The other three Dublin local authorities all voted to keep the rate of tax paid in their areas varied by the maximum 15 per cent reduction.

Tipperary county councillors voted to increase the rate of tax homeowners pay by 10 per cent, making it one of the few local authorities to vary the tax above the standard baseline rate.

Limerick City and County Council councillors have voted to increase the LPT by 7.5 per cent for 2018, which is down from the 10 per cent increase added to the base rate this year.

Galway County Council voted to keep the current variation of a 10 per cent increased rate for the coming year.

But the vote was taken while only 19 of 39 councillors were in the chamber, and 16 voted to keep the current rate for 2018.

The council will hold a special meeting on Friday, where it is expected the vote will be overturned.

The LPT automatically returns to the base rate each year and the current regime is based on house valuations from May 2013.