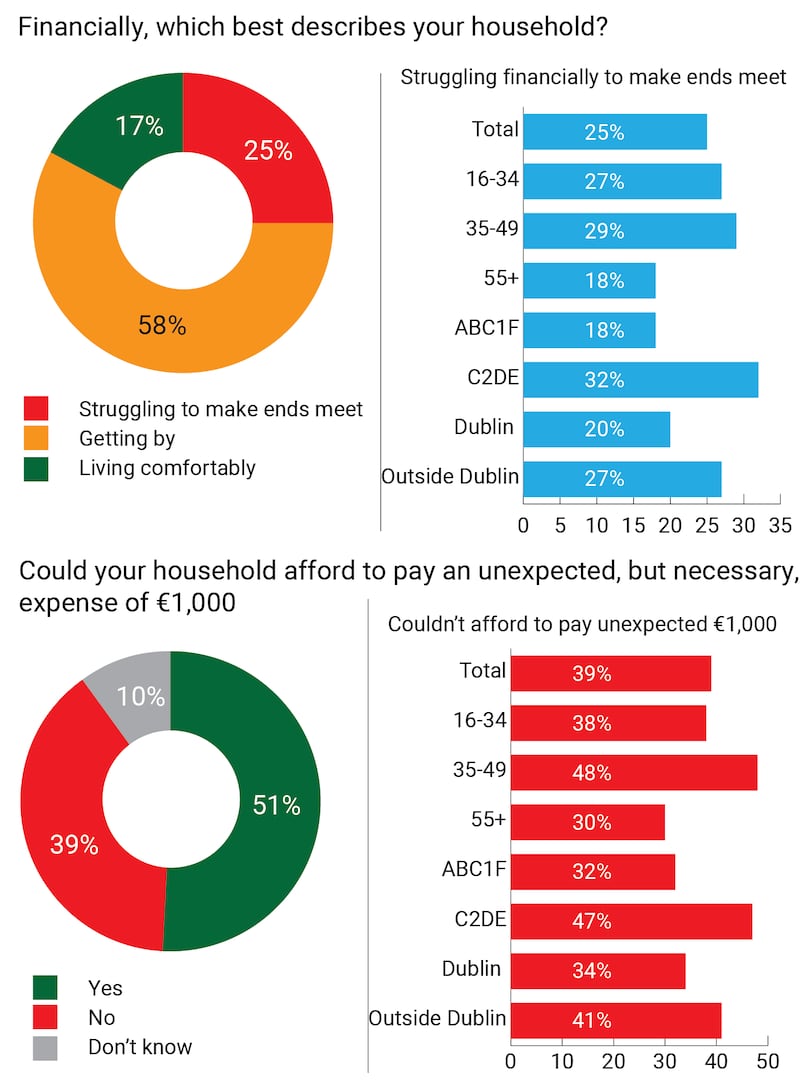

Close to half of Irish adults are afraid they could not cover the cost an unexpected but essential expense of €1,000, while a similar number see no end to the cost of living crisis, according to new research from Behaviour & Attitudes.

The study indicates that families with teenage children are struggling most and suggests that the cost of food has replaced energy as the cause of primary concern for most people.

It also points to high levels of general concern and anxiety, with about one quarter of the population consistently in difficulty.

According to the research, 25 per cent of Irish people are struggling to make ends meet, while 58 per cent say they are “getting by” when it comes to their personal finances.

READ MORE

While 65 per cent of those polled said they have less disposable income now than this time last year, this has reduced from 79 per cent in September 2022

The 16-54 age cohort and non-professional workers are struggling most but the gap between the so-called middle classes and blue-collar workers has lessened, with more of the former group now telling researchers they have been negatively impacted by the cost of living crisis.

While 65 per cent of those polled said they have less disposable income now than this time last year, this has reduced from 79 per cent in September 2022.

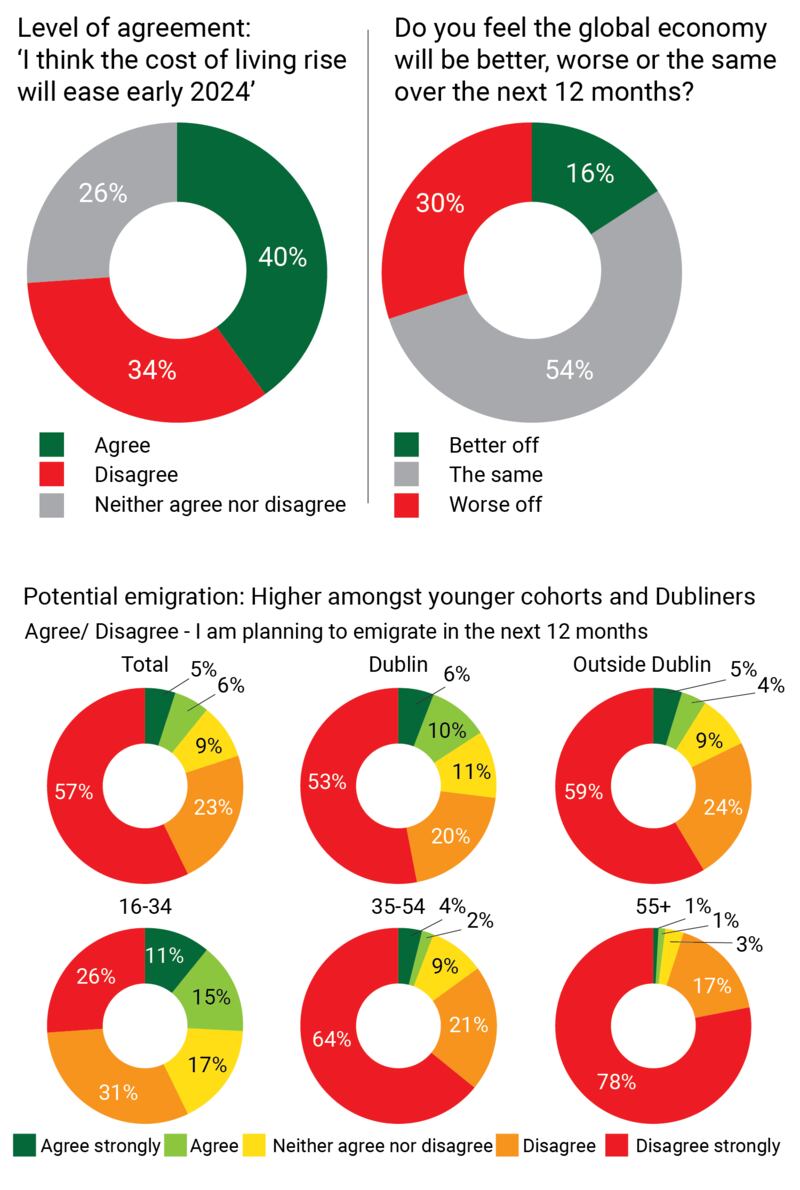

Potential emigration is low but the study suggests there is higher openness among younger cohorts and Dubliners, with 10 per cent of people aged between 16 and 34 strongly agreeing that they are planning to emigrate at some point.

Despite the challenging times, almost three quarters of those polled are positive about both Ireland as a place to live and their own lives, with positivity increasing with age.

Rent/mortgage worries

While the study suggests that people are “getting used to” higher prices, two in five said they could not afford to pay an unexpected but necessary €1,000 expense.

When asked what aspect of the crisis is the most worrying, 81 per cent said food prices with 73 per cent pointing to energy costs.

In addition rent/mortgage worries have increased this year compared to last, with one third now most worried about this expense, a percentage which is driven by under-55s in particular.

There’s high inflation and our money’s not going as far, but the economy seems to be still buoyant and we have a lot of jobs

— Luke Reaper, B&A managing director

“People are uncertain, they’re tense and they’re anxious,” said B&A’s managing director Luke Reaper.

He told The Irish Times the “range of worries that people have has expanded. It was energy, now it is energy, food, housing, fuel. There’s mountains of increases.”

[ Last mile of disinflation the hardest, warns ECB deputy headOpens in new window ]

He also pointed to the high levels of employment in Ireland and suggested that it was “propping everything up” in terms of sentiment. “There’s high inflation and our money’s not going as far, but the economy seems to be still buoyant and we have a lot of jobs.”

Mr Reaper said the research showed more middle class people have been more exposed to the crisis, “undoubtedly due to the interest rates rises and everything else that’s happening. And two thirds of people are unsure as to whether or not things will be any better this time next year and wonder if this just going to drag on and on.”