At the start of February, The Irish Times carried an article suggesting Irish people would be worse off by about €2,000 over the course of 2022 once the higher costs of energy, fuel, food and more were totted up.

While the article, written weeks before the Russian invasion of Ukraine, seemed bleak then, now it appears wildly optimistic. The grim reality today is that the financial impact of the cost-of-living crisis on Irish people is likely to be much, much worse than we imagined.

Higher electricity and gas bills will add well over €1,000 to most households’ annual costs in the months ahead, while the price of motor fuel will see the cost of keeping cars on the road climb by at least €750, with higher-priced groceries adding a similar amount to annual bills.

On Friday, SSE Airtricity announced that it was increasing the prices it charges for both gas and electricity by more than 45 per cent.

READ MORE

The move will see quarter of a million customers pay more than €600 for their electricity over the course of a year and over €500 for gas. It comes on the back of an increase of more than 30 per cent in May.

Combined its increases over the last 18 months have seen its customers gas bills climb by over €1,000 while its average electricity customers will have to pay €1,100 more than they did previously.

While other companies have yet to roll out autumn increases, the current energy climate and skyrocketing prices on wholesale markets makes that virtually inevitable.

Then there is the higher cost of borrowing for hundreds of thousands of people on tracker and variable rate mortgages and a general rate of inflation that has not been seen in Ireland since the early 1980s, which is driving the price of almost everything higher.

When all the price hikes people have faced and are likely to face as we head into winter are totted up, many households will be worse off by about €4,000 by the time the bells ring in 2023.

And that is a net figure so there will be a considerable number of Irish households that will need to earn an extra €8,000 just to stay in the same financial position they were in last winter.

It is in this context that the Society of St Vincent de Paul (SVP) is anticipating a record number of people will seek its help this year, with the charity already reporting a 20 per cent increase in the number of struggling households seeking help so far in 2022.

And things are likely to get worse before they get better.

Recent figures published by retail analysts Kantar suggest grocery inflation remains a key challenge, having hit 9.5 per cent last month, the highest level since July 2008, when it first started tracking the data in Ireland.

More specifically, food and drink prices are continuing to climb, with consumers paying 8.1 per cent more per item in August than they were in the same month last year. Essentials such as butter, milk, flour, eggs and bread recorded some of the biggest price rises.

According to Kantar, the price rises mean the average annual shop will climb by a “staggering” €662 over the next 12 months if consumers buy the same products as they did last year. And if the cost of groceries climbs further — as it looks certain it will — then the costs to consumers will increase by even more than this.

David Berry of Kantar says it is “certain that we will be in to double-digit inflation figures next month as the rate of increase has been pretty consistent across most categories”.

“There will be crops that were planted three months ago that will not be harvested until three or four months from now, and all the higher input costs of today will be passed on to consumers when those products hit the shelves”

— TU Dublin academic Damian O’Reilly

He says a 15-plus percentage increase in the price of many staples “is all down to the higher cost to feed animals, energy and labour” and notes a rate of grocery inflation of 9.5 per cent compares with a five-year average of 0.8 per cent. That spike means that “all the room for manoeuvre among the retailers has been stripped out and price increases are going to have to be passed on [to consumers]. This time last year the rate of inflation was at zero. That is because it is a very competitive industry and competition has kept prices low for a long time.”

He suggests it is hard to predict how bad things might get given how fast the crisis has evolved in the last six months.

[ Mark Paul: Profit is not a dirty word but greedflation most certainly isOpens in new window ]

Retail expert and TU Dublin academic Damian O’Reilly says that while we are seeing “the largest increases for almost 40 years”, the increases “do have to be taken in the context of many years when food prices were going in the opposite direction”.

He says it “looks like the spike in food prices will be with us for the rest of the year and into 2023 at the very least”.

“There will be crops that were planted three months ago that will not be harvested until three or four months from now, and all the higher input costs of today will be passed on to consumers when those products hit the shelves.”

O’Reilly stresses the picture is not entirely bleak, and nowhere near as bad as it was in the early 1980s — the last time Ireland saw an inflationary spiral like the one we are living through now.

“Back then, inflation was very high but so was unemployment. The good news right now is that we have almost full employment and the ESRI is upbeat about the broader economy and saying it will grow by more than 6 per cent this year. For many people it will simply be a question of putting up with the price hikes at the moment until we come back to a more normal situation. If energy prices come down and supply issues are sorted out, we will begin to have a better handle on what is happening.”

The basket of goods that cost €84.88 at the end of April cost €93.03 at the end of the week just past, a rise of €8.15

He stresses that in the short term, people on lower incomes will have to be given more support while everyone will have to do whatever they can to cut their own household costs including shopping smarter, reducing waste and being more energy efficient in the home. “I think we will all have to have a different mentality in the months ahead,” he says.

“We need to cut down on the huge amount of food waste — it is phenomenal.”

According to a recent assessment published by Goodbody Stockbrokers, Irish households throw out about €62 worth of food each month with the scale of the waste topping 55kg annually.

The report’s author, Jason Molins, believes that as a result of the cost-of-living crisis, we might be on the cusp of a change, with the spike in inflation potentially leading to shoppers paying more attention to spending and looking more closely at the food they waste.

But people will only be able to do so much and, according to Berry, there is “no immediate fix. I don’t think we will see an easing-off of the inflation this year. There are things that people can do but there are no bright spots on the horizon.”

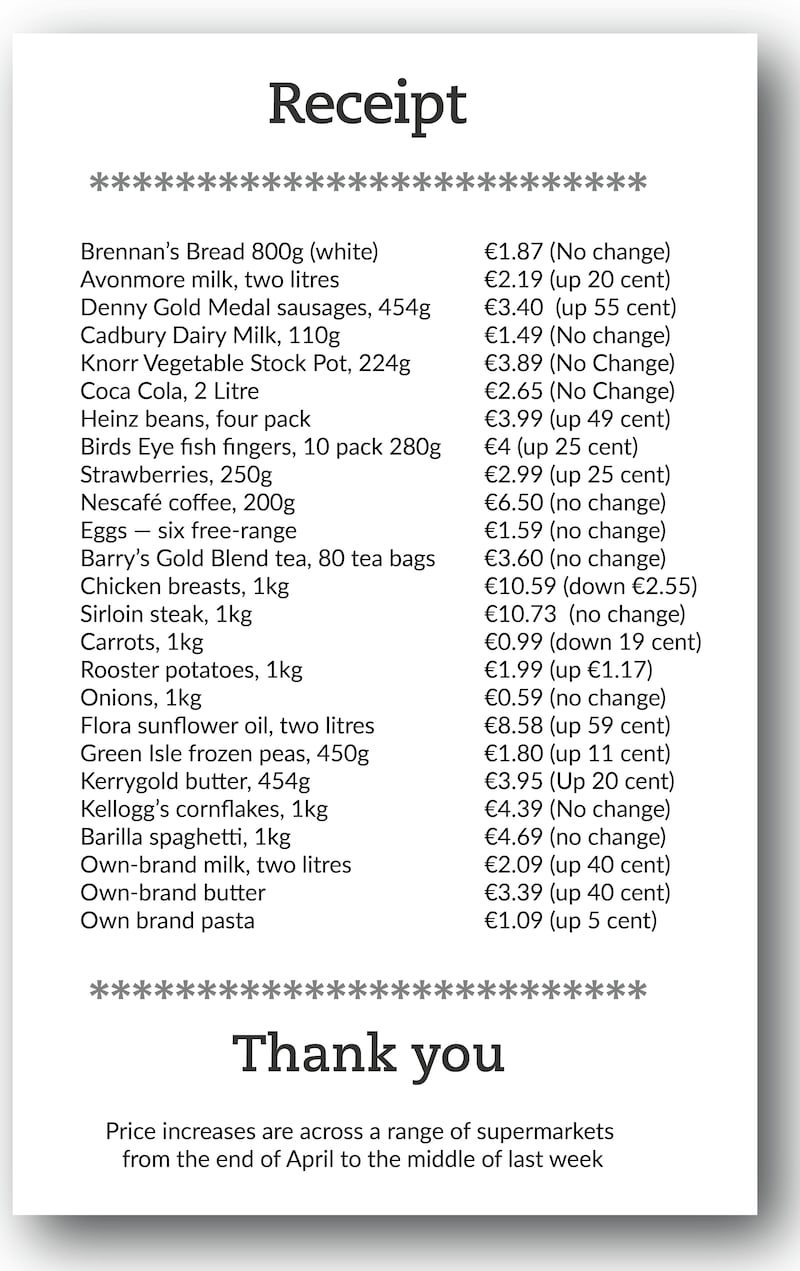

In recent months The Irish Times has charted shifts in the price of 25 commonly bought products. Since we began doing so at the end of April, the cost of a small number of the products has fallen, but far more have risen.

The basket of goods that cost €84.88 at the end of April cost €93.03 at the end of the week just past, a rise of €8.15.

Spread out over the course of a full year, and the higher cost of those items — just a small percentage of the typical weekly shop — will climb by more than €420.

We will check on these items next month to get a sense of how they are moving and what impact that will have on our pockets. If you notice any big price increases, let us know at pricewatch@irishtimes.com.