There's nothing like a cold, hard number to focus attention on an issue. The Economic and Social Research Institute (ESRI) report on the gender gap in pension income, published on Wednesday, throws into stark relief just how poorly women in the workforce fare when it comes to retirement.

The issues facing working women and pensions are not new. Too many do not have any pension arrangements outside the State pension system and, even there, the rules conspire to reduce the amount a woman is likely to receive. Data shows that when they are in work, women often work less than full-time and are more likely to take career breaks to accommodate family commitments.

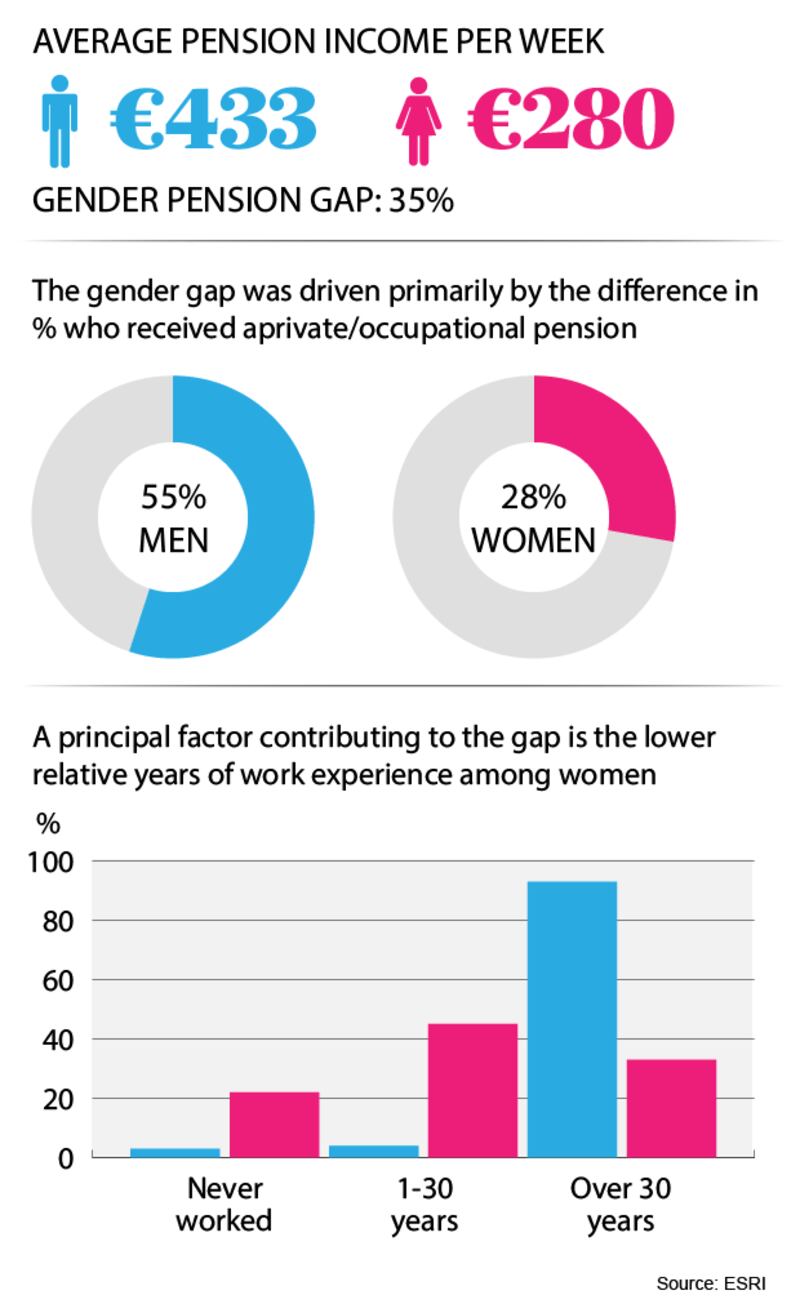

Time is critical in building up pension pots. Looking at people who have already retired, the ESRI report notes that while 93 per cent of men spend more than 30 years in work, just one-third of working women do. That undermines the chances of women having pension income which matches that of men.

To make matters worse, many don't start pensions in the first place – possibly deterred by the more fractured nature of their working lives. According to 2010 data cited by the ESRI, just 28 per cent of women open an occupational pension compared to 55 per cent of men.

But it is the bottom line figures that really bring home the scale of the problem.

On average, women will have €153 less a week in pension income to live on than men. That’s over €650 a month or almost €8,000 a year.

And it matters. People are living longer – women even longer than men – and in better health. An income shortfall of €650 a month, albeit before tax, is more than enough to make a difference in the standard of living women can enjoy in retirement compared to men.

The ESRI's Adele Whelan, a co-author of the report published on Wednesday, is clear in the issues that policymakers – read, the Government – must address. More women need to be brought into the workforce in the first place and, once they are there, better efforts need to be made to ensure they are not forced out. That means better and more affordable childcare (or more favourable workplace arrangements) and long-term eldercare services.

Those measures would also serve to narrow the gap in the level of contributory state pension women receive compared to men – which will remain even after the introduction of the new total contributory approach to assessing state pension entitlement from next year.

Identifying the problem is one thing. Addressing the challenge is more complex, and costly. While the gender pay gap in work is closing slowly, to date little of substance has been done to close gender gap in retirement.