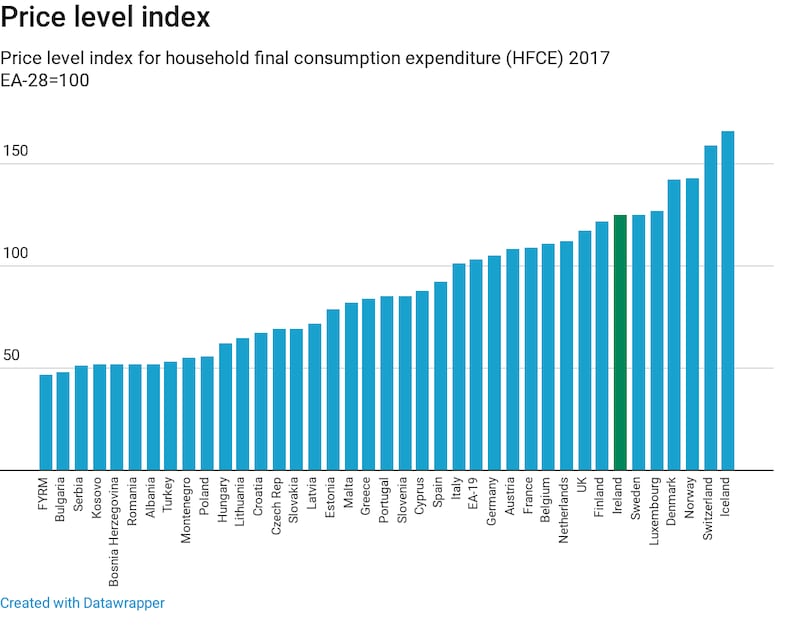

Ireland remains one of the most expensive countries in the EU to live in. And that’s official.

According to new figures from Eurostat, the EU's statistical agency, Ireland is third most expensive among EU countries for a basket of consumer goods and services, "beaten" only by Denmark and tiny Luxembourg.

Looking at the wider table of 39 European countries measured in the list, we come 7th, with the notoriously high-priced Iceland and Switzerland leading the pack.

This is some achievement given the brutal recession in Ireland which saw widespread price-cutting, sharp wage cuts and a collapse in rents and house prices.

So why should consumer prices in 2017 in Ireland be 25 per cent above the euro area average?

It is important to remember what is being measured here are the costs of daily goods and services, before we add in some key areas where we know Ireland is relatively expensive – notably rent, the cost of paying a mortgage and childcare.

Each of these sectors have unique factors and this column will deal with each in turn over the coming weeks.

50% of average wage

In childcare, for example, a family with two children can face a gross full-time childcare bill equivalent to 50 per cent of an average wage compared to a euro zone area average of 22 per cent, according to OECD figures.

Even allowing for more generous treatment here via the tax system and child benefit the cost is still near the top of the league. A new childcare subsidy is helping parents, though some facilities reportedly hiked fees following its introduction.

The reason why childcare costs so much here is controversial – a major Government-sponsored study by accountants Crowe Howarth is currently looking at this. Providers blame the high costs of provision and meeting regulations, as well as paying property rental and high Irish insurance costs. Childcare will be the subject of a future column

Meanwhile, a succession of reports show rental costs here close to the top of the European league – a recent report by Mercer consultants said this was a prime reason why Ireland is the most expensive euro zone city for people moving here to work. Dublin is now jammed, with huge demand for rental property, particularly in key areas close to the city centre and little supply. Meanwhile a succession of other studies have also shown that other living costs here are now the same or higher than other major European cities.

This has economic as well as social implications. High prices mean employers have to pay more to employees if they are to afford to live.

And high rental and housing costs are now a significant barrier in terms of attracting and retaining investment, particularly to the Dublin region. It becomes a cycle.

There is nothing wrong with being a high-cost economy is you have levels of productivity – and thus incomes – to support it.

But while Ireland is doing well, our cost of living is still causing obvious difficulties for many, even for those on reasonable wages.

Reasons why

Let us break down the key reasons why prices are high here.

1. It is an unavoidable fact that Ireland’s peripheral location and low population density imposes costs on businesses,compared to operating in larger, more populous markets.

2. The small size of the market may mean less available profit – and so less competition.

Competition in areas of the grocery market, notably the entrance of Aldi and Lidl, have pushed down prices.

But in other areas competition has been less evident, allowing prices to remain high, Look at mortgage rates, for example, only now starting to fall closer to European levels.

3. “Irish” factors. Like in every market, Ireland has its peculiarities. Insurance costs are high partly because claims costs are high. In turn high legal costs are part of this story. The banking crisis devastated a sector which is only now turning its mind back to customer service and offering value.

And we have chosen to tax some products very highly.

The Eurostat data, for example, show Ireland has the highest cost for alcohol and tobacco, a reflection in large part of high excise duties.

Energy is also heavily taxed – and is likely to rise further as the Government hikes up carbon taxes.

And then there is the question of whether lobbies and vested interests are particularly powerful in Ireland at protecting their position. To which the answer, in some cases anyway, is a clear yes.

Chicken and Egg

So, the reasons for high costs in Ireland are varied and relatively high prices are reflected, to some extent, in wages and earnings.

"[Cost of living] is a very interesting but also quite complicated topic," says Professor Edgar Morgenroth of DCU. The link between high prices and high wages, for example, is a chicken and egg issue, he said.

Then there are the range of issues which go into determining prices, ranging from the peripheral nature of Ireland – meaning a higher cost to transport goods here - to our relatively small market to a range of institutional and other factors peculiar to Ireland.

In short there is no one magic reason.

If we are, indeed, the Rip-Off Republic, to borrow the title of the Eddie Hobbs 2005 TV series, then there is no single explanation for why.

However, a suspicion remains that in Ireland the consumer still takes second place when certain policy decisions are made.

the rip-off X factor – here is where the rows start

Banking regulation in recent years, for example, seems to have been tilted to getting the Irish banks back to financial health, rather than encouraging competition.

And powerful bodies like the legal and advisory professions have maintained high costs right through the recession, upping the cost base across the economy.

Interestingly, while Ireland is, in general, an expensive place to live, general inflation in consumer prices has been notable by its absence in recent years.

This has been more than offset by rises in key areas – such as rental costs and house prices – have risen quickly.

Squeeze

So the gradual squeeze on the consumer continues.

Just this week, we saw another round of increases in electricity prices, despite the fact that Eurostat figures show we already have the fourth highest domestic electricity costs in Europe.

Vested interests play a bigger role in Ireland

And then there is the rip-off X factor – and here is where the rows start. Businesses have an influential place in the Irish economy and have often used this to protect their own position.

“Vested interests play a bigger role in Ireland,” says Morgenroth. “ By serving their own sectoral interests they push up prices more generally.”

Businesses should be slower to blame the Government for Ireland’s competitiveness problems, he says, and instead look at how they operate.

Businesses

The examples are legion.

The banking sector, having been rescued by taxpayers, has been overcharging customers on mortgages and other loans to return to profitability – though it must be said that there are other reasons for high borrowing costs.

Average rates on a new mortgage here are 3.15 per cent, according to the most recent figures, way above the euro zone average of 1.8 per cent.

Only recently has evidence emerged of some emerging competition in the mortgage market.

regulated sectors like energy and transport seem too often to operate in a closed loop

The general insurance sector ran into huge problems in the run up to the bust, with prices in areas like car insurance set way too low.

The sector – under pressure form the Central Bank to get its books back in order – has overcompensated and pushed prices up and while there has been some moderation recently,many motorists are likely to still face hiked premiums.

It blames claims costs – which is part of the story – but consumers have also been paying for past mismanagement and face a lack of clarity on why they are asked to pay so much.

And regulated sectors like energy and transport seem too often to operate in a somewhat closed loop, where a decision is made by a State-appointed regulator on how much return businesses need, despite costs in many of these areas being above EU average.

When business talk about the “competitiveness agenda”, they generally mean ways to push up their profits, rather than cut prices faced by consumers.

Measures to combat anti-competitive behaviour in the Irish market are rare, though the Competition and Consumer Protection Competition has raided the officers of general insurers and is looking at how prices are set and in particularly how competitors are allowed in to the market and whether the domestic players have been trying to block entry by withholding access to information.

The insurance sector strongly denies this. It will be interesting to see what emerges from this investigation.

The future

It is not all gloom for Irish consumers. A combination of the internet and fierce competition in sectors like pharmaceutical and cosmetics, clothing, furniture and electrical goods, means the volume of goods being sold is rising faster than the total value.

As a result, on average, either many prices are falling and consumers are getting better value, or consumers are opting for cheaper products.

The reality is probably a mixture of the two.

On the flip side, there is anecdotal evidence of rip-off prices for punters and tourists due to the economic recovery – exorbitant prices for hotel rooms in cities at weekend, the return of the €10 glass of wine and so on.

The best way for Ireland to deal with being an expensive country, of course, is to try to keep prices relatively stable for a few years and hope other countries experience inflation and pass you out.

However, the general standstill in inflation across Europe in recent years makes this difficult.

Another issue is that some prices paid during the boom, for housing, goods and services and wages remain in the minds of many as the ‘real’ level, witness the demand for the restoration of wages. This is influencing decisions.

So it is unlikely Ireland will loses its position near the top of the prices league for some time yet – if indeed we ever do.

Next week: The economics of investment and the disruption it causes. Should the new Dublin bus route go through your front garden, or the Metro dig up your child’s football pitch?