Every October the budget comes along and we eagerly await what impact the Minister for Finance’s pronouncements will have on our personal bottom line. But, while we listen carefully to what the minister says about the universal social charge and tax bands and rates, how many of us consider what impact a myriad of other indirect taxes – and levies – has on our disposable income? And how many of us equate that to a greater drain our disposable income?

Indirect taxes have been called stealth taxes and with good reason – we don’t fully realise their impact.

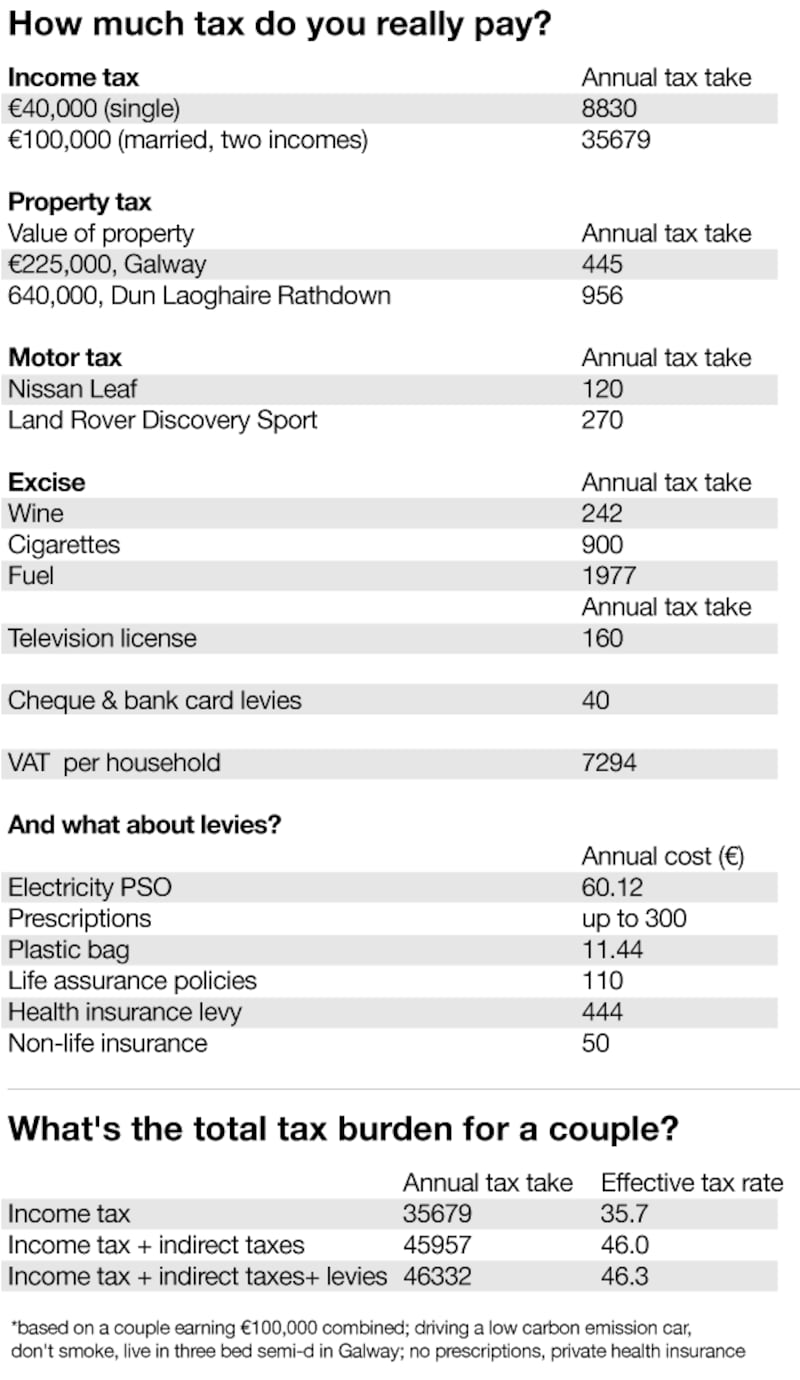

Figures show that one in three Irish residents don't pay tax on their income: yet they pay indirect taxes on a host of other outgoings, including VAT on goods and services, excise on alcohol and fuel, as well as other charges such as property tax. In addition, levies on everything from health insurance to our electricity bills gift another chunk of our income to the State – often without us realising.

As Donal de Buitléir, a director of Public Policy, an economic think tank, notes, back in 2012 the government put up the rate of VAT from 21 per cent to 23 per cent, bringing in an estimated €670 million extra to the State’s coffers. That was at a cost of about €140 a head, or about €394 for each household. And where were the protests for that move?

All these extra costs really add up and significantly increase your overall tax burden. Consider the example of a couple earning €100,000 jointly. If you look at income taxes alone, their effective tax rate is just 35.7 per cent. But when indirect taxes are added to the equation, the effective tax rate jumps to 46 per cent or 46.3 per cent when you include the impact of levies.

Income tax

It’s the one we’re all most used to thinking about as a tax – the tax we pay on our income. Of course it’s not just income tax – we also pay the universal social charge and PRSI, which means the deductions add up.

A single person on a salary of €40,000 for example, will pay an effective tax rate of 22 per cent, giving up more than €8,000 in these three charges every year. A married couple, with two earners and a joint income of €100,000, will lose 36 per cent, or about €35,600 of their earnings every year.

Property tax

It’s technically a tax on an asset but with this asset producing no income – unless you avail of the rent-a-room scheme – the tax liable on the asset comes out of your income stream.

If you own your own home, or even multiple homes, you’ll be subject to property tax. Levied at a rate of 0.16 per cent on the value of your property, a homeowner in Co Galway with a house valued in the €200,000-€250,000 band will pay an annual tax of €445. Someone in Dún Laoghaire-Rathdown local authority area on the other hand, with a property value of between €600,000-€650,000, will pay €956 a year.

Motor tax

If you own a car, you’ll pay a handsome sum in motor tax every year to cover the cost of caring for roads, paying for Irish Water and anything else the government decides – the money collected goes into the local government fund rather than being set aside for specific road projects.

It brings in more than €1 billion each year for the State. How much you pay depends on what kind of car you have; if you have a low carbon-emissions car, you’ll probably pay less than €200 a year but if you have an older car with a big engine, it could set you back as much as €1,809.

An electric Nissan Leaf will cost you €120 a year, while a Land Rover Discovery Sport costs €270.

Excise

If you like a tipple, you’ll hand even more over to the State’s coffers. With one of the highest duties on wine in Europe, for each bottle of wine purchased at a cost of €10, some €4.84 in excise duty goes to the exchequer, according to Publicpolicy.ie.

Given that a bottle of wine a week would not be an unusual rate of consumption in households across Ireland – if not too low – you could expect someone to hand over another €242 on the purchase of 50 bottles a year. Beer drinkers too also hand over a considerable sum, giving up €1.49 on a €5 pint.

For smokers, the burden on a pack of 20 cigarettes is also considerable. At a typical cost of €11 for a pack of 20, the State’s take comes to 78 per cent, or €8.62. Based on an intake of 40 cigarettes a week, a smoker will pay a further €900 to the State each year.

If you drive, you’ll also be losing more of your money on excise duties on fuel. A tank of diesel for a Ford Focus for example, might cost you €62.48 but of this some €38.03, or 61 per cent, goes to the State. If you fill your tank once a week, you’ll lose another €1,977 to the State’s coffers.

Television licence

If you have a television, you need a television licence. Available at an annual cost of €160 this is another indirect tax, going mainly to fund the national broadcaster, RTÉ.

The licence fee brings in about €178 million a year. If you watch a streaming service such as Netflix or even a TV service such as the RTÉ player on your computer or tablet, you don’t currently need a TV licence although the Minister for Communications is once again considering a change to this position.

Cheque and bank card levies

If you have a bank account in this State it’s likely you will also be paying tax on it. Cheque books, ATM cards, credit cards – they’re all liable to stamp duty, levied at various rates. If you have a simple ATM card for example, you’ll pay up to €2.50 a year on it (€0.12 a transaction); an ATM/debit card will set you back up to €5, while a charge of €30 a year applies to a credit card. The levy on cheque books is even more onerous; 50 cent for every cheque you write.

Over the course of a year, it would not be unusual for someone to give up €40 to the exchequer in debit card, credit card and cheque fees.

VAT

VAT is the biggest source of indirect taxation; it’s levied on everything from televisions to shampoo and, in 2016, it brought in €12.4 billion for the exchequer.

Recently published census data shows that the population of Ireland is 4.76 million, with 1.7 million households. So, based on the total VAT take, we could estimate that individuals (including children) incur annual VAT bills of about €2,605; perhaps a better indicator is per household, which would give us a charge of a staggering €7,294 a year.

Obviously it depends on consumption – the more you spend, the more you pay – but it’s a useful guide to the amount of money you can expect to hand over to Revenue in VAT.

Panel: What about levies?

It’s not just indirect taxes that the unsuspecting public pay; a host of levies are also imposed on your income at every turn:

Electricity bill: €60.12 a year

The PSO or Public Service Obligation levy is a subsidy to support national policy objectives, including securing the energy supply and the use of renewable energy sources in electricity generation. Introduced in 2010, the levy is imposed at a rate of €5.01 each month.

Prescriptions: up to €25 a month

Since 2011, medical card holders have paid a levy on each prescription of €2.50 an item, with a cap of €25 a month, up from 50 cent when it was first introduced.

Plastic bag: 1 bag a week = €11.44 a year

If a bag in the supermarket costs you 30 cent, 22 cent of this will go to the government, thanks to the levy on plastic bags which was first introduced at a rate of 15 cent a bag in 2002.

Life assurance policies: €110 a year

If you have a mortgage protection policy, life assurance cover, or simply a savings policy with a life assurer, you will have to pay 1 per cent of the value of this to the government in the form of a levy each year. This means for, example, that if you have all of the above, you could be forking out €110 to government each year (based on mortgage protection premium of €400; life assurance of €600; investments of €10,000) .

Health insurance levy: €444 a year

If you’re one of the two million-plus people in Ireland who have private health insurance, you will also have paid the State a levy to cover the costs of “risk equalisation” – or compensating insurers with more older, and therefore more expensive, members. The levy increased in April from €399 to €444, and to €148 per child, an increase of €14.

Non-life insurance levy: €50 a year

Thanks to a history of insurance failures, stretching back to the collapse of the PMPA insurance company in 1983, Irish consumers have long been paying extra for the cost of home and car insurance. While the original PMPA/ICI 2 per cent levy came to an end in 1992, it was replaced by a general 3 per cent levy, or stamp duty, on non-life insurance.

In addition, consumers are also paying a 2 per cent levy due to the failure of Quinn insurance, which was introduced in 2012 and may run until 2037. It brings in about €65 million a year.

So, a consumer with combined insurance policies costing €1,000 a year will incur a levy charge of about €50.