European stocks pared losses on Thursday as upbeat euro zone business growth data and strong US jobs data lifted sentiment on a dull day of trading, while rating actions and ex-dividend trading knocked UK shares lower.

The S&P 500 dipped as the raft of upbeat data fanned fears of rising inflation, eclipsing reports that US president Joe Biden has offered to scrap his proposed corporate tax hike.

DUBLIN

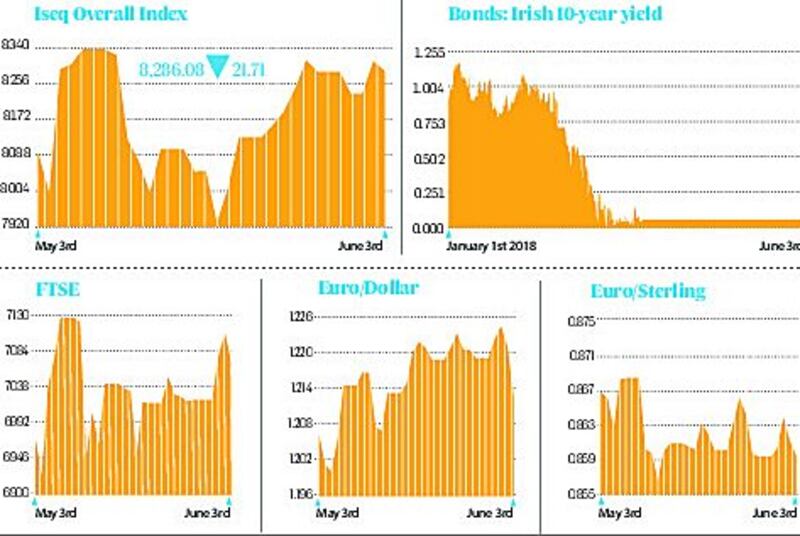

The Iseq fell by 0.26 per cent after recovering most of its lost ground following a post-lunch sell-off.

Among the most significant fallers on the day was Ryanair, which finished the session down 4.6 per cent to €16.36.

The airline's woes were rooted in the news that the European Union has delayed putting the UK on its white list of restriction-free countries for travel, while the British government removed Portugal from its green list.

Ormonde Mining bucked the trend across Europe for falls in resource stocks, finishing ahead by more than 8 per cent at 1.3 cents per share.

CRH rose by 0.28 per cent to €43.42, after its peer Saint-Gobain reported positive trends for sales in April and May.

LONDON

A host of British companies, including National Grid and Kingfisher, traded without entitlement for dividend, pulling UK's FTSE 100 0.6 per cent lower.

Miners, including Anglo American, BHP Group and Rio Tinto fell between 1.9 per cent and 2.8 per cent. Discount retailer B&M European fell 3.9 per cent after it said trading would likely remain volatile this year and organic growth would likely decline.

National Grid fell 4.1 per cent to the bottom of the index, while home improvement retailer Kingfisher lost 2 per cent, as they traded without entitlement to a dividend payout.

The domestically focused mid-cap FTSE 250 index declined 0.6 per cent, easing from a record peak scaled in the previous session.

BT Group fell 1.9 per cent after Deutsche Bank downgraded the telecom group's stock to "sell," saying it is overvalued.

EUROPE

The pan-European Stoxx 600 index was down 0.1 per cent after falling as much as 0.8 per cent earlier in the session.

After a record expansion in euro zone factory activity, IHS Markit’s final reading showed the bloc’s dominant service sector sprang back into life last month as restrictions eased.

The automobiles and auto parts and healthcare sectors gained, while miners fell the most.

French spirits group Remy Cointreau slipped 3.3 per cent after hitting a record high as it topped estimates for full-year operating profit growth and handed investors an 85 per cent dividend hike.

Construction materials group Saint-Gobain gained 4.2 per cent after forecasting record operating income and margin in the first half of the year.

NEW YORK

Major stock indexes pared losses, with the Dow rising 0.1 per cent after reports of the major concession by the US president.

Apple, Amazon, Microsoft and Alphabet were among the biggest drags on the benchmark S&P 500 as the high-growth stocks, whose future cash flows are discounted when interest rates are higher, fell.

Banks and energy stocks, which track an improving economic outlook, added 0.7 per cent and 0.5 per cent.

Shares of AMC Entertainment reversed their sharp gains to fall 22.7 per cent after the company launched its second share issue in three days. FireEye dropped 15.4 per cent after the cybersecurity firm said it would sell its products business, including the FireEye name, to a consortium led by private equity firm Symphony Technology Group for $1.2 billion in cash.

A bright spot was General Motors, up 5.7 per cent, as the carmaker expects first-half 2021 financial results to be significantly better than its forecast as semiconductor chip deliveries pick up in the second quarter. Rival Ford added 6.1 per cent. – Additional reporting: Reuters