European stocks rose on Monday, led by growth-exposed sectors, as encouraging comments from central bank head Christine Lagarde boosted optimism over a speedy economic recovery this year.

In the US, the Dow was set for its best day in more than three months as investors piled back into financials and energy shares that are set to benefit from a broader economic recovery.

DUBLIN

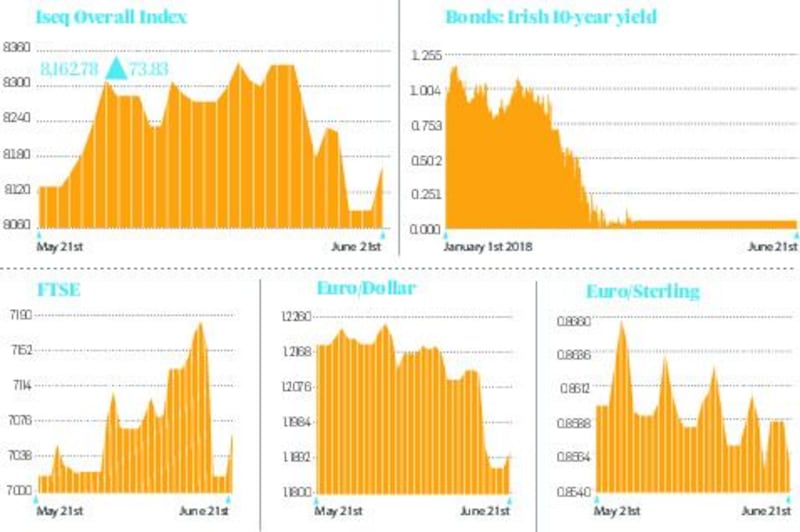

The Iseq in Dublin finished close to 1 per cent higher. It was held back by the two main banks which both fell, as the European Central Bank indicated it will keep the money supply flowing, which keeps a lid on the sovereign bonds held by many financial institutions.

AIB finished the session down 1.7 per cent to €2.24 per share, while Bank of Ireland was down 1.9 per cent to €4.57.

Kerry group rose by 1.7 per cent to close at €108.45, after it announced it had acquired food preservatives group Niacet for €853 million. It will be integrated into Kerry's global food protection and preservation platform.

Paper and packaging giant Smurfit Kappa Group rose 1.4 per cent to €44.55. The business does well when consumer sentiment rises as its packaging is used with a lot of retail goods sold online.

Market heavyweight CRH also rose 2.4 per cent to €42.55. as US politicians continue to haggle over an infrastructure plan.

LONDON

The FTSE 100 ended higher, helped by gains in mining and industrial stocks, while supermarket chain Morrisons was the top gainer on the mid-cap index. Britain's fourth largest grocer by sales, it surged 34.6 per cent after it rejected an offer worth £5.52 billion (€6.45 billion) from private equity firm Clayton, Dubilier & Rice. Rivals Tesco and Sainsbury's rose 1.7 per cent and 3.8 per cent.

Industrials gained 1 per cent, led by outsourcer Capita, which rose 9 per cent after it said it was on track to post revenue growth for the first time in six years and agreed to sell its 51 per cent stake in Axelos.

Dollar-earning consumer staples stocks, including British American Tobacco, Reckitt Benckiser Group,and Diageo Plc gained between 0.5 per cent and 0.8 per cent.

EUROPE

The pan-European Stoxx 600 index ended 0.7 per cent after falling to its lowest since June 3rd earlier in the session. The index also marked its best day in nearly three weeks. Automobile and chemical stocks were the top gaining sectors, while basic resources surged 1.3 per cent from a three-month low.

The Stoxx 600 extended gains after Lagarde said euro zone economic growth could rebound quicker than expected as consumers begin spending again. She also reiterated that the European Central Bank would maintain accommodative policy.

Italian-American vehicle maker CNH Industrial rose 0.8 per cent after agreeing to a deal to buy Raven Industries.

German vaccine maker CureVac fell 10.5 per cent after a report said Germany’s financial watchdog was investigating possible insider trading in the firm’s shares, which had tumbled after the biotech firm announced its Covid-19 vaccine proved only 47 per cent effective.

NEW YORK

The Dow Jones Transports Average, considered a barometer of economic health, jumped 1.9 per cent, while the domestically focused small-cap Russell 2000 added 1.7 per cent.

The broader banking index rose 2.0 per cent after hitting a two-month low last week. Value stocks, which include banks, energy and other economically sensitive sectors and have led gains in US equities so far this year, outperformed their growth-oriented technology counterparts.

Crypto stocks including miners Riot Blockchain, Marathon Patent Group and crypto exchange Coinbase Global dropped between 3 per cent and 4 per cent on China's expanding crackdown on bitcoin mining.

Moderna gained about 3.6 per cent after a report said the drugmaker is adding two new production lines at a Covid-19 vaccine manufacturing plant, in a bid to prepare for making more booster shots. – (Additional reporting: Reuters)