On a Saturday morning in mid-October 2015, as Americans enjoyed the beginning of a long weekend on the anniversary of Christopher Columbus’s arrival on the other side of the Atlantic, US marshals showed up at the door of a more recent European arrival.

Anglo Irish Bank's former chief executive David Drumm, who had left Ireland for Massachusetts in 2009 in the wake of the bank's implosion, was arrested on foot of an Irish extradition warrant in front of his wife and one of his two daughters at his 4,089 sq ft home in the upmarket Boston suburb of Wellesley.

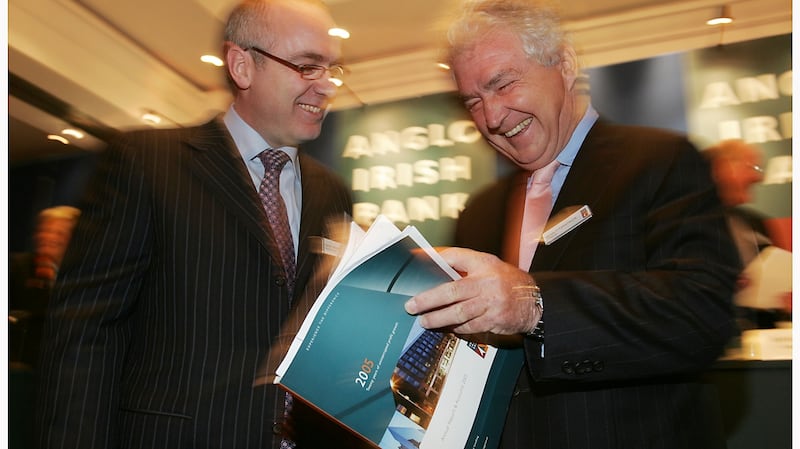

Charged at the time with 33 criminal offences relating to his role at Anglo, which he led between January 2005 and December 2008, Drumm would spend about five months in custody before being extradited to Ireland in March 2016.

Nine years to the month after Drumm left Ireland for the the US, the former banker (51) was found guilty by a jury of nine men and three women in Dublin on Wednesday on two counts of fraud. The State’s case was that Drumm comspired with others in circulating €7.2 billion between Irish Life & Permanent and Anglo Irish, to create the illusion that Anglo’s customer deposits base was much strong than it actually was.

Drumm faces sentencing by Judge Karen O'Connor on June 20th, as taxpayers continue to count the ultimate cost of now-defunct Anglo Irish's €29.3 billion rescue during the crisis, which helped tipped the Republic into an international bailout. The bank, renamed Irish Bank Resolution Corporation in 2011, was put into liquidation in February 2013.

Skerries native

A native of the north Dublin seaside town of Skerries, Drumm was one of eight children of a truck driver. After leaving the local Christian Brothers school, he qualified as a chartered accountant, specialising in liquidations, with Deloitte & Touche.

Drumm went on, four years later, in 1988, to join Dundalk-based Enterprise Equity, the venture capital arm of the International Fund for Ireland, before returning briefly to the world of accountancy and, then, in 1993, being offered an assistant manager role in the then fledgling Anglo Irish Bank (after failing to secure a manager position).

The pay, at £23,000 a year, was 40 per cent below what Drumm had been on in his previous job. But the move paid off and within two years, he had been promoted to manager.

By 1997, Drumm was in charge of a team of lenders and was asked by then chief executive, Seán FitzPatrick, to go to the US to find opportunities for the bank. Departing for Boston with his wife, Lorraine, and two daughters, Drumm spent the next five years elbowing in on property deals in the Boston area.

However, the naming of the then 37-year-old in September 2004 as the bank’s next chief executive came as a surprise. One of four internal candidates interviewed to succeed FitzPatrick, who’d been in charge for 22 years, Drumm was the only one not a director. The favourite, Tiarnan O’Mahoney, quit within months.

Anglo Irish’s loan book trebled to €73 billion during the four years Drumm was in charge, as it bankrolled some of the State’s largest property developers. However, its stock market value soon began to fall after reaching a €13 billion peak in May 2007, before going into freefall on St Patrick’s Day 2008 as investors fretted about its exposure to the slowing property market.

When the government of the day stepped in with a snap guarantee of the banking system in September 2008, weeks after the implosion of US investment bank Lehman Brothers, Anglo Irish was the weakest link, on the brink of collapse.

Stepped down

Drumm stepped down six days before Christmas in 2008, hours after FitzPatrick, then group chairman, resigned after disclosing to the stock market that had been in the habit of moving his tens of millions of euro of bank loans to Irish Nationwide Building Society at the group's year end, keeping them from view of investors and auditors.

Within weeks, Anglo Irish was nationalised and the Garda fraud unit and investigators from the corporate watchdog had raided the bank’s St Stephen’s Green offices after news emerged of IL&P’s temporary deposits, and the group’s €450 million of loans to 10 investors to buy a stake in the bank as the family of businessman Seán Quinn was forced to unwind a leverage 28 per cent position.

Drumm left Ireland for the US in June 2009 and filed for bankruptcy in Boston the following year after failing to reach a settlement with his former employer on loans provided mostly to buy Anglo Irish shares.

Financial statements at the time showed his stated debts amounted to $14.3 million, while he valued his assets of $13.9 million, including a €5 million pension pot, $3.6 million in unpaid salary and other money he claimed the bank owed him.

However, in denying Drumm the chance to a fresh start in 2015, US bankruptcy judge Frank Bailey said the former banker knowingly and fraudulently misled creditors by failing to disclose hundreds of thousands of cash and property transfers to his wife, starting in 2008 as the bank was facing collapse. The judge concluded at the time that Drumm was "not remotely credible".