As the Government announces its reopening plans, we know one thing. There is no perfect guide here on the balance between vaccination and reopening. But there are some markers we can use.

The latest Department of Finance economic forecasts contain a fascinating analysis based on what has happened in Israel.And the UK reopening is six or seven weeks ahead of us and we can see how it is managing the vaccine/reopening balance. So where do we stand?

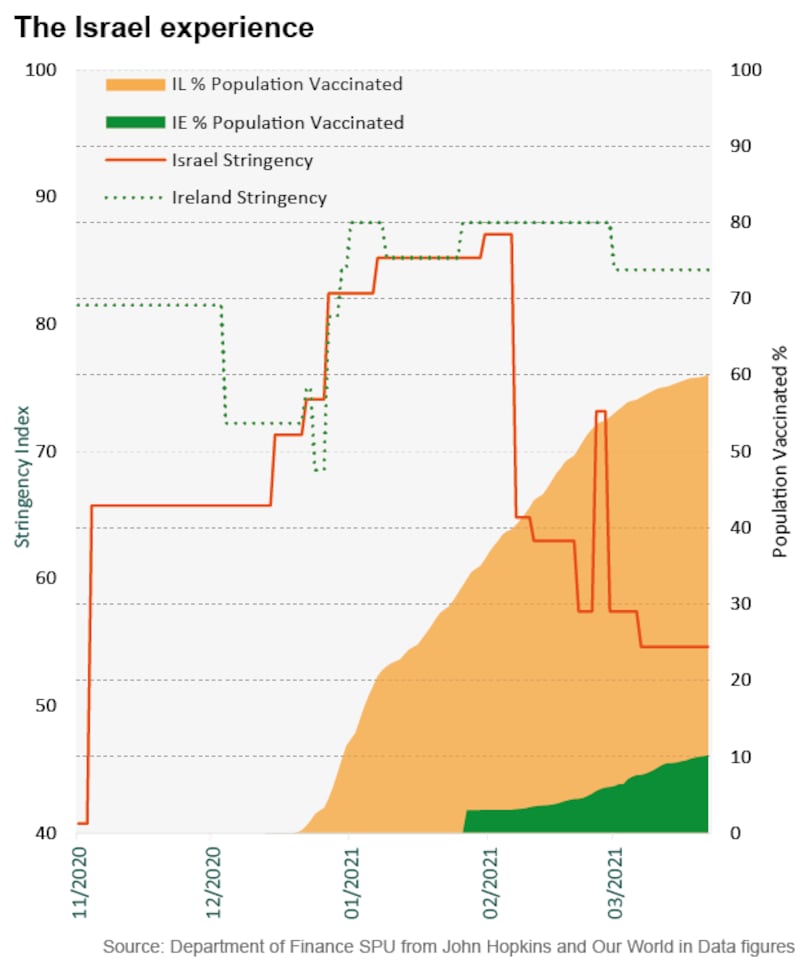

The key message from the Department of Finance analysis is that Israel managed to reopen large parts of its economic and society, without sending cases higher, once 40 per cent of the adult population was fully vaccinated, which in its case was early in February .

You could also argue that it was the level of first vaccines that was more important – they had reached not far off 60 per cent of the adult population with at least one short by then.

The message from some other countries – including some parts of the US and Chile is that if you move too quickly, case numbers can rise even as vaccines reach more of the population.

Israel, after a big surge in January , has reported case numbers and hospitalisation generally falling since it passed the 40 per cent barrier , with no Covid -19 deaths reported on some recent days for the first time since last June.

Meanwhile the economy and society are reopening, mask-wearing is no longer mandated outdoors and indoor venues like gyms and restaurants are open to those who have been vaccinated, but only via the use of vaccine passports.

Meanwhile the UK is moving to 60 per cent plus with one dose, and has largely reopened outdoor activities, with a wider reopening due in mid-May.

How might Ireland’s numbers and reopening plan compare with these countries who are ahead of us in terms of vaccinations? And what does this mean for the economy?

1. The vaccine programme

The programme has had so many twists and turns that it is impossible to be exact about what might be achieved and, particularly, whether the Government target of having more than 80 per cent of the adult population vaccinated once and at least 55 per cent twice by the end of June can be achieved. This means around 4.7 million vaccines having to be administered.

The arrival of the one dose Johnson&Johnson vaccines, albeit restricted to the over 50s, is included in the 4.7 million total.

If the promised 600,000 doses due by June arrive – and are all used – then it really helps with the targets, especially for getting fully vaccinated numbers up.

Vaccination numbers also have to continue rising. The seven day rolling average , which has just exceeded 200,000, needs to shoot up to more than 400,000 plus a week in June, reaching 60,000 plus per day.

When might we reach the 40 per cent of adults fully vaccinated figure? At the moment the fully vaccinated figure is about 10 per cent of those over 16 – with 26 per cent having at least one vaccination.

The back-loading of delivery of Johnson&Johson – most arriving in late May and June pushes the likely 40 per cent fully vaccinated date back a bit.

We could get there by mid-June, but it will be tight. As the 600,000 J&J allow around 15 per cent of the over-16 population to be vaccinated in one go, its deployment is crucial here and remember much of it will be arriving towards the end of the second quarter.

As a significant part of reopening is due during June, there isn’t much room for slippage on the vaccine targets.

2.The reopening

Plug these numbers into the reopening schedule and you can see why the Government is taking it relatively cautiously, even if some dates have come forward a bit.

Israel was coming from a different place – a massive January spike – when it started its reopening in early February. But by then it had made remarkable speed with vaccinations.

Since it reopened, its progress is generally encouraging, with falling case numbers, hospitalisation and illness, albeit with some concerns – as are everywhere – with certain variants.

Another interesting comparator is Scotland. It now has 61 per cent of over 16 year-olds with at least one jab and 25 per cent with two. This has allowed it – just this week – to reopen outdoor dining and drinking, allow limited indoor dining, reopen tourist accommodation and all non-essential shops and hairdressers.

Ireland will not reach these kind of total vaccination doses until into June – we will have have a different mix of first and second vaccines. And again here this require the daily numbers to rise sharply.

So with Ireland perhaps seven weeks behind Scotland, you can see why the Government here does not want to rush the fences, particularly for activities with higher risk involving indoor gatherings.

Encouragingly, Scotland hopes to lift further restrictions by mid May and more moving into June, returning to something not too far from “normality” by then, with people starting to move back into offices and some larger indoor gatherings.

How the UK experience plays out will be a crucial pointer for Ireland and if places like Scotland are largely reopened going into June with no significant problems it will be a great sign for Ireland.

3. The economic price

There is good news and bad news in the latest Department of Finance forecasts on the economic impact.

The good news is that the signs are that the economic impact of the latest lockdown was less serious than the first one last year. This is partly due to the blanket nature of the early part of the 2020 lockdown.

However the department also believes that the economy has adapted to an extent – consumers are shopping more online, for example and companies that can have streamlined their operations and found ways to keep going.

The department estimates that domestic demand fell by around 4 per cent in the first quarter of this year , a third of the drop during the first quarter of last year.

Using other high frequency spending and movement data the department’s analysis suggest that the overall impact of the latest lockdown may have been around half of the first one in 2020.

While it will be some time before the two can be fully compared with detailed data, the clear message is that the economy has adapted – albeit that lockdown still puts a heavy cost on closed sectors.

The department has also started to look at the potential longer-term impact of the pandemic, the bad news, on economic activity – the permanent loss to economic activity due to lower investment, damaged productivity and increased unemployment. In economic jargon this is known as “scarring”.

As it points out this is still very difficult, but it points to international estimates suggesting that the impact may be around 3 per cent of GDP.

In terms of job losses, the Central Bank has guesstimated that unemployment could be 100,000 higher as we exit the pandemic and some people find their jobs are gone for good.

The next few months, however, look set to be dominated by reopening and rehiring with all forecasters expecting a significant boost in economic activity driven by businesses restarting and consumers spending, helped in part by massive savings built up over the past year by those who have remained in work.