One of the largest privately-owned businesses in the US, Koch Industries, is among the multinationals whose dealings are covered in the latest batch of leaked documents concerning structures in Luxembourg.

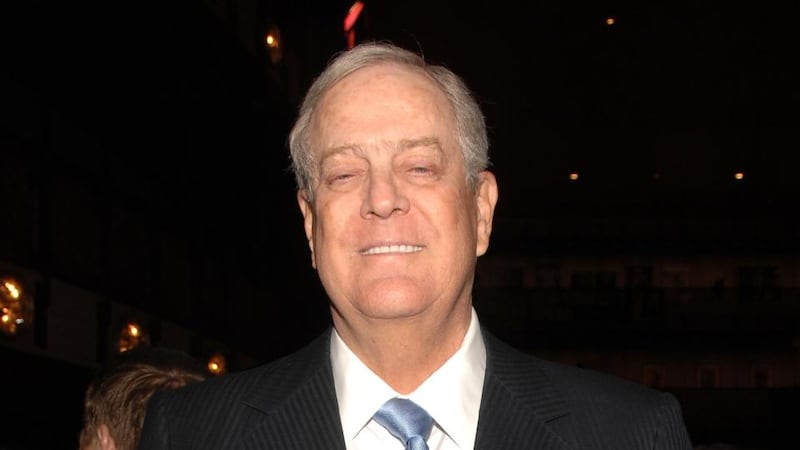

An energy and chemicals conglomerate, Koch Industries is owned by Charles and David Koch, who have been in the centre of political controversy in recent years as they've sought to use their money and connections to elect Republican candidates who are sympathetic to their libertarian beliefs.

Invista

The Koch Luxembourg transactions involved its chemicals and polymers subsidiary Invista BV.

The documents, prepared by Ernst & Young, describe “Project Snow,” a 26-step restructuring of Invista designed to simplify the company’s structure, centralise its cash flow into Luxembourg, and pay down debt, according to the document.

The restructuring was worked out in four meetings in late 2008 and early 2009 between Ernst & Young employees and Marius Kohl, of Luxembourg's revenue authority.

In the restructuring, the subsidiaries of Invista passed millions of dollars back and forth, converting shares to debt and occasionally dissolving firms.

Tax-free “hidden distributions” among subsidiaries are just one type of head-spinning transaction included in the confidential tax ruling approved by Luxembourg authorities. Another section describes a $736 million (€593m) loan that gets passed from company to company until a US-based subsidiary becomes “both the debtor and creditor of the same debt,” and the debt is cancelled.

Central to the restructuring deal is Arteva Europe, which manages the cash flows of the company’s European operations through Luxembourg. From 2010 through 2013, the company paid $6.4 million in taxes on $269 million in profits. Its highest annual tax rate was 4.15 per cent.

Shannon, Co Clare

Kosa Luxembourg Capital, one of the companies that form part of the Invista group, has a branch office in Rineanna House, in Shannon, Co Clare. The group finance company reported a profit of $10.7 million in 2012 and had loans to affiliated entities of $349.6 million. Staff costs were $16,109 and tax on profits was $2,119.

“Like all Koch companies, Invista conducts its business lawfully, and pays its taxes in accordance with applicable laws,” said Rob Tappan, a Director of External Relations for Koch Companies Public Sector. The company declined to respond to detailed questions about its Luxembourg operations.

Koch Industries admitted in 2011 that Invista, had funnelled a dozen illegal campaign contributions to political candidates in Virginia, Delaware and Kansas and to the US Democratic Governors Association. They agreed to pay a fine of $4,700.