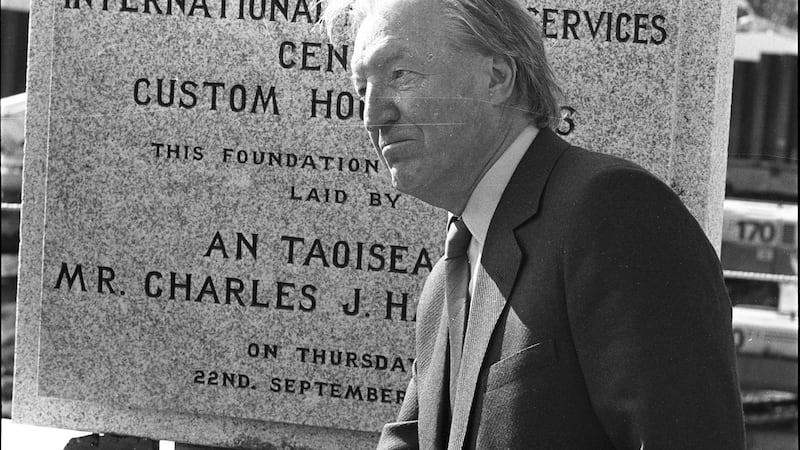

Charles Haughey insisted suggestions made by financier Dermot Desmond be included in his written responses for a major 1988 interview he gave as taoiseach with a global finance magazine about the new International Financial Services Centre (IFSC).

The close collaboration between Haughey and Desmond, along with his company NCB stockbrokers, in marketing the new centre is disclosed in Department of the Taoiseach documents released under the 30-year rule.

A central part of the marketing campaign for the new centre was a supplement in the prestigious Euromoney magazine. Haughey would not do a face-to-face interview, but agreed to respond to questions put in writing by the magazine.

The records contain drafts of his detailed answers including a last draft. A note in handwriting stated: “Final version cleared but to include Dermot Desmond’s comments as considered suitable.”

In a separate handwritten note from the NCB chairman, Desmond wrote in longhand: “Some suggestions attached.”

Desmond’s handwritten amendments included references to a network of double taxation agreements, an observation that Ireland’s regulatory standards were the “very highest”, and a reference to Ireland’s focus on technology-related financial services.

“We believe that our excellent communications facilities and computer literate workforce can give us a stronger competitive edge in this area. I believe that Ireland can become a significant springboard for US and Japanese institutions building a presence in EEC financial markets,” Desmond wrote.

In the finished article, Haughey was quoted highlighting "our excellent, modern communications system, and our computer-literate workforce", as well as the government's confidence that the IFSC "will attract a number of major US and Japanese investment houses and banks".

The volume of material shows the huge emphasis that was placed on the IFSC by Haughey after he returned as taoiseach in 1987. The centre turned out to be a major success. However, in the intervening years questions were raised about hundreds of “brass plate” companies locating in the IFSC purely for tax avoidance purposes.

There was also criticism of the IFSC clearing house group which allowed the finance industry direct access to government, and a degree of influence when the yearly Finance Bill was being drafted.

Incentives

The IFSC was Desmond’s idea – he later described it as “the best thing that I have been involved in” – and it was championed in government by Haughey. Among the initial incentives for companies which located in the docklands zone were a 10 per cent rate of corporation tax; exemption from rates for 10 years; double rent allowances against trading income for the first 10 years; 100 per cent capital allowance; no stamp duty; and no exchange controls for dealings in foreign currencies to overseas clients; and zero VAT on services from the centre.

Financial dealings in the centre were also to be completely independent of the local system. Profits could also be reexported home or used in development, or investment, projects elsewhere in the world.

The Euromoney supplement wrote: "Charles Haughey, Ireland's prime minister, has a glamorous dream. In it he sees Dublin as an international venue for top rank financial services firms of every description."

However, the Department of Finance and the Revenue Commissioners initially resisted any efforts to allow corporations and companies for which finance was an ancillary rather than a core activity to locate in the IFSC and benefit from the low corporate tax rate.

Desmond's firm NCB was involved in a protracted campaign to secure a place for a division of Heinz, then chaired by Tony O'Reilly, at the IFSC. NCB argued the treasury management functions of a company like Heinz was allied to to control of stocks, purchase of raw materials, commodities as well as sales co-ordination. NCB also asserted it should also include credit control, currency and interest rate exposure management.

A handwritten note from a senior NCB executive to a senior official stated: "Sorry for missing the IFSC meeting last Thursday. I have not been entirely idle. Attached is a note I sent to Paddy Mullarkey [the secretary general of the Department of Finance] about Heinz.

“After a lot of effort we have got Heinz buzzed up again about coming. Paddy’s initial reaction to my note was ‘would they not consider coming to Shannon? [where there was a free trade area]’. He is to get back to me by Wednesday next but unless we have a clear cut Yes I believe strongly we will have to raise it as a poking issue in the context of the Finance Bill.”

Heinz executives

In February 1988, NCB arranged for Heinz executives to have a meeting with Haughey. In a briefing note Desmond stated that the [Heinz] application had been “turned down by the IDA before Christmas after consultation with Department of Finance”.

“Heinz remain very strongly interested. There is a five minute meeting with Taoiseach on Wednesday which would reinvigorate interest and maintain goodwill.”

In the note Desmond said the nub of the problem was the 1987 Finance Act which defined trading operations. He believed Heinz’s operations could be included under that heading. He pointed out that by year three of operations in the IFSC the Heinz subsidiary could make £8 million in profit, yielding £800,000 to the exchequer in tax.

“[The Department of Finance is] beginning to show some flexibility but say that while they would allow speculative commodity broking they have difficulty with commodity broking aimed largely at multinationals’ own raw materials requirements.”

Desmond argued there was a “danger of getting too hung up on definitions”.

“What we are looking to attract is high quality financially-related jobs. Few, if any, multinationals would be willing to put in genuine treasury management operations without also hanging some ancillary headquarter functions off them. We must recognise this practical reality…To have Heinz’s name in the IFSC would be a huge boost to its credibility.”

Swiss operation

The secretary general in the Department of the Taoiseach, Pádraig Ó hUiginn,placed a huge degree of importance on a visit by executives from Swiss Bank to Haughey. “To get a Swiss operation in the centre would be a big prize. Many would follow their lead,” he wrote.

Today the IFSC says it is host to half of the world’s top 50 banks and to half of the top 20 insurance companies. Since 2006 companies in the IFSC are subject to the normal corporation tax rate of 12.5 per cent.