Since the depths of the financial crisis in Ireland in 2010, successive budgets have come in ahead of target, delivering bigger than planned reductions in government borrowing. This has been important in reassuring Irish people (and financial markets) that the Irish economy has a reasonably bright future.

This year the Government had planned for a deficit of 2.7 per cent of GDP. It now seems likely it will come in at less than 2 per cent of GDP. This time last year, the plan for 2016 was to have a deficit of 1.9 per cent of GDP, whereas now it seems possible that it will be less than 1 per cent, in spite of the mild stimulus that the budget for next year entails.

The key factor in the budgetary outperformance this year is the exceptionally rapid growth in corporation tax revenue. Even at the end of October, revenue from this source was €2 billion ahead of expectations, with the most important month for revenue of November still to come.

Corporation tax revenue this year may represent at least 3.2 per cent of GDP compared with 2.4 per cent in 2013 and 2014. This “surprise” in corporation tax accounts for all of the outperformance in the Government accounts this year.

We saw in 2008 how the very high stream of tax revenue coming from the property boom could disappear overnight. The public finances had been planned assuming fairly stable tax revenues. When the property market collapsed, revenue from stamp duty and VAT also collapsed, greatly aggravating the problems we faced.

This highlighted the importance of planning the public finances on a more “normal” revenue profile and not relying on ephemeral revenue bonuses from unusual economic activity. Thus, to avoid a repetition of past mistakes, it is important to establish the reasons for this year’s corporation tax revenue bonus and to what extent it can be relied on in future.

Multinationals

In 2014, the vast bulk of the corporation tax revenue (86 per cent) came from four sectors – manufacturing (especially pharmaceuticals), distribution, financial services and IT services. In the case of two of these – manufacturing and IT services – nearly all of the revenue came from multinationals. In the other two sectors, distribution and financial services, there are some significant Irish companies paying tax, but there are also a substantial number of multinationals. Thus, to an important extent, the trend in corporation tax revenue reflects the profitability and behaviour of multinationals.

One significant factor in explaining trends in the multinational sector has been the decline in the euro relative to the dollar. Because multinationals producing in Ireland price in dollar, while their Irish costs are in euro, their profits expand more rapidly with a weak euro. This is particularly true of the IT services sector, where there is a statistically significant relationship between the sector’s profitability and the dollar-euro exchange rate.

Reversal

While there is no sign of the euro strengthening in the coming year, a reversal could occur in the longer term, reducing IT sector profitability and, hence, tax revenue from this source.

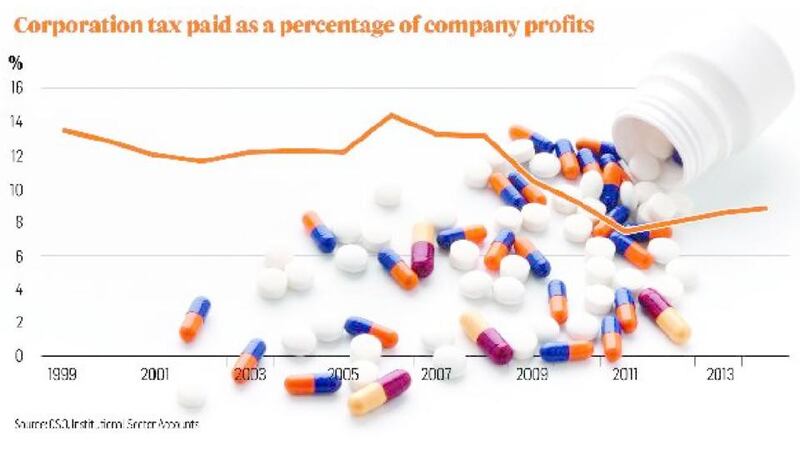

Looking at the proportion of company profits paid in corporate tax, the crisis years saw a fall-off compared with the Celtic Tiger era. As shown in Figure 1, the ex-post average tax rate on company profits ranged between 8 per cent and 9 per cent from 2010 to 2014.

The decline from earlier years partly reflected the effects of the huge losses in the financial sector. However, the surge in tax revenue this year suggests that the tax rate may be returning towards its pre-crisis level. Nonetheless it is still a matter for concern as to why the rise is occurring.

One possibility could be that the changed approach by OECD countries to corporate tax policy could see changing behaviour by some large multinationals. They may prefer to pay some corporate tax in Ireland rather than exploit opportunities to locate much of their profits in jurisdictions where they are exempt from tax but subject to much opprobrium. If such strategic decision-making by multinationals were the explanation, the increase in revenue could prove to be insecure.

In the longer term, a range of factors is evolving that will affect policy on corporation tax across the OECD area.

Over time, rates of corporation tax have been falling in most OECD countries. For example, the gap between the rate in Ireland and Britain is now quite limited – 12.5 per cent compared with 20 per cent. In Northern Ireland it will fall to 12.5 per cent in 2018 and is even lower in Estonia.

Thus the competitive advantage that a low rate provides is diminishing. However, there are other potential changes mooted that could substantially reduce the attractiveness of the low rate in Ireland and also greatly erode the corporation tax actually paid in Ireland.

I first argued in 1999 that Ireland should wean itself off dependence on a low corporation tax rate as the key feature of its competitiveness. This was because of the strategic risks that such dependence involves. Significant progress has been made in this regard.

As I outlined in an earlier article, today the bulk of the growth in the economy is coming from the non-multinational sector, which comprises a very large number of Irish companies. For the future, we need to continue to attract foreign direct investment that brings real value to the economy in terms of employment, but we also need to guard against undue dependence on the tax revenue that arises from the exceptionally high level of profitability of multinationals in Ireland.

Figure 1: Corporation tax paid as a percentage of company profits Source: CSO, Institutional Sector Accounts