Aviva will be hoping to capitalise on the continuing international appetite for prime Dublin office investments with the launch of Royal Hibernian Way on Dawson Street to the market.

Joint agents TWM and JLL are guiding a price of €80 million for the landmark scheme, offering the prospective purchaser an initial yield of 3.16 per cent based upon the current rent roll of €2.78 million. There is scope, according to the selling agents, to increase this yield to 5.8 per cent through the completion of an upcoming rent review and the letting of vacant units.

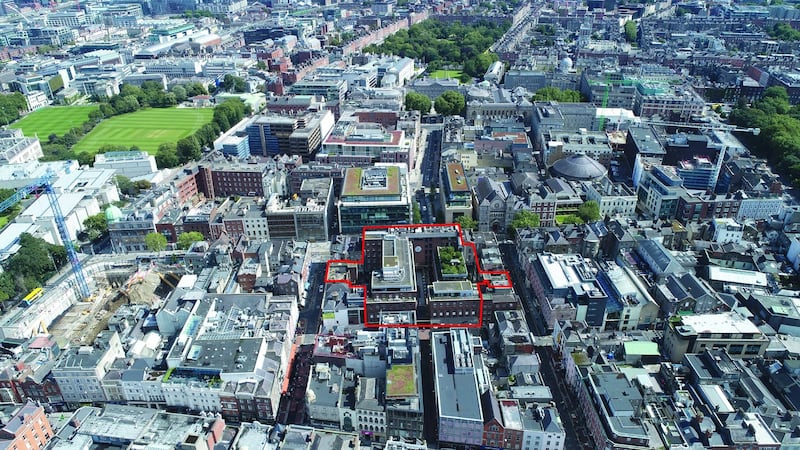

Located on what is arguably Dublin city centre’s most sought-after thoroughfare, Royal Hibernian Way is a mixed-use development extending to 92,888sq ft. The bulk of the scheme (72,000sq ft) is comprised of office accommodation while some 21,000sq ft is dedicated to retail and hospitality.

The majority of the office space (66,000sq ft) serves as the headquarter building for Davy Stockbrokers, while the remaining offices, located at 12 Duke Lane, have been left vacant intentionally by Aviva as planning permission has already been achieved to double the size of the building.

The retail quarter underwent a thorough upgrade recently, and is occupied by high-end retailers including Boylan's Shoes, Carol Clarke Jewellers and Leonidas Chocolates, and a strong hospitality offering which includes the renowned Marco Pierre White steakhouse, Isabelle's restaurant, and the Lemon & Duke bar, owned by Noel Anderson and his business partners, rugby legends Sean O'Brien, Jamie Heaslip and Rob and Dave Kearney.

The overall annual passing rent is approximately €2.78 million per annum. However, there is scope, according to the joint selling agents, to significantly increase this rent by leasing the vacant retail units where there is active tenant demand or where they have been kept vacant to facilitate the redevelopment of 12 Duke Lane. There is also an imminent rent review on Davy’s office space.

Recent evidence in the market suggests that the rental level for this space is in the region of €50 per sq ft or higher. The figure represents a substantial discount to rental levels achieved for newer office buildings nearby, which prior to Covid-19 had achieved as high as €70 per sq ft.

In addition to extending 12 Duke Lane, the prospective purchaser may look to increase the overall floor area of the existing office space, subject to planning, as parts of the building extend to five floors over ground level while other sections extend to only three stories over the retail. A feasibility study undertaken by Aviva suggests there is also scope for internal modifications and to link the rear block with the front blocks to provide a single floor plate centred around the open walkway.

Stand-alone asset

Royal Hibernian Way is the largest stand-alone asset held by Aviva on behalf of life and pension policyholders in the Friends First Commercial Property Fund. The proposed disposal of the property follows Aviva's €43.5 million sale to Iput earlier this year of its 29.2 per cent interest in Riverside One and its half share in Unit D, Kilcarbery Distribution Park.

Commenting on the decision to sell its Dawson Street development, Aviva’s head of property fund management, Suzie Nolan, said: “We have decided to strategically dispose of this asset and redeploy the proceeds into other value-add redevelopment projects or to potentially allow us pursue acquisition opportunities.”

Michele Jackson of joint selling agents, TWM says: “Royal Hibernian Way is a significant prime real estate block in Dublin city centre with a profile to appeal to both seasoned international and domestic investors looking for attractive investment opportunities within the capital markets.”

John Moran, CEO at JLL said: “With an immediate cashflow and asset management opportunities in the short term coupled with the development opportunities, we believe Royal Hibernian Way will appeal to those with the vision and experience to reposition this prime asset over a number of years.”