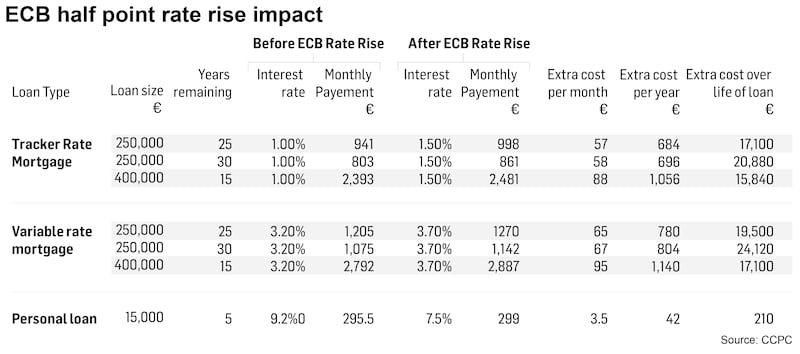

The European Central Bank (ECB) increased interest rates across the euro zone by a half percentage point on Thursday, marking its first hike since 2011, in a move that will immediately affect about 300,000 tracker mortgage holders, according to industry sources. About €25 billion of trackers mortgages is involved.

Homeowners on other rates, including roughly 200,000 on variable mortgage rates, will have to wait to see how the Irish banks react to the announcement. While Permanent TSB and Bank of Ireland said they have no plans to increase the costs of variable or new fixed-mortgages as a result of the ECB move, most other lenders, including AIB, said they were keeping their rates under review.

The 0.5-point rise to the ECB’s main lending rate, which has been at zero for the past six years, will lift the cost of Irish tracker mortgages, which banks here stopped offering in 2008.

What an interest rate rise means for you

It would see monthly payments on a typical tracker loan with €150,000 outstanding, priced at a 1 percentage point premium to the ECB rate, and with 15 years left to run, rising to €931 from €897, according to Joey Sheahan, head of credit at online broker MyMortgages.ie.

READ MORE

ECB president Christine Lagarde said the decision to go with 0.5 of a percentage point rise, twice as much as had been forecast early last month, was partly down to an acceleration of euro zone inflation, which was running at 8.6 per cent last month. The ECB’s target is to have inflation of 2 per cent over the medium term.

[ Explainer: Why is ECB raising rates now for first time in more than a decade?Opens in new window ]

[ Borrowers could be facing into a season of rapid ECB interest rate hikesOpens in new window ]

Ms Lagarde said the ECB governing council also agreed to set up a new programme that would allow it to step in and buy the bonds of euro zone countries whose market borrowing costs spiked in an “unwarranted, disorderly” way.

“Price pressures are spreading across more and more sectors, in part owing to the indirect impact of high energy costs across the whole economy,” Ms Lagarde told a press conference, adding that the euro’s recent decline against the US dollar, to briefly touch parity last week for the first time in two decades, is also importing inflation into the euro area.

She added that while the ECB rate hikes should ultimately raise borrowing costs for households and businesses, “the most precious good we can deliver — and we have to deliver — is to bring inflation down to 2 per cent in the medium term”.

While the ECB president said it would continue down the path of rate increases, she declined to give guidance on what is in store at the next monetary policy meeting in September, other than to say that decisions would be “data-driven”.

The ECB also decided to lift its deposit rate from minus 0.5 per cent to zero, abandoning a charge it had been imposing on banks for excess deposits stored with the Frankfurt-based institution, and which banks across Europe had been progressively passing on to customers in recent years.

Bank of Ireland said on Thursday that a charge of 0.65 per cent that it had been applying to €15 billion of customer accounts with a minimum of €1 million on deposit would come to an end on August 3rd.

ECB governing council members were increasingly concerned over recent weeks that the central bank had fallen behind the curve on inflation. Central banks in the United States, the UK and elsewhere have already moved to raise the cost of borrowing in an attempt to get inflation under control.

The ECB is also grappling with fears of an economic downturn and political instability in Italy, one of the region’s most indebted countries. Mario Draghi stepped down as prime minister on Thursday after losing the support of a key party, triggering a snap election that will be held in September.

.