Among the dozens of UK ministers and aides that fled Boris Johnson’s government in the 48 hours before he bowed to the inevitable on Thursday was one Chris Philp, the UK serial entrepreneur-turned-Tory MP, who got out with a little over an hour to spare before the BBC reported his boss was quitting.

Citing the need for “integrity, honest and trust in politics”, the junior culture minister, with responsibility for tech and digital, said he could no longer serve under Johnson.

Still, Philp urged Johnson, in his resignation letter, tweeted just after 8am on Thursday, to press ahead with the release of a long-delayed review of gambling laws, which the UK government had promised late last month to publish within weeks.

“The gambling review is with No 10 at the moment for final approval, containing strong measures to protect people from the ravages of gambling addiction,” Philp told Johnson. “I have met the families of those who have committed suicide as a result of gambling addition, and I would strongly urge you to deliver the review in full and undiluted.”

READ MORE

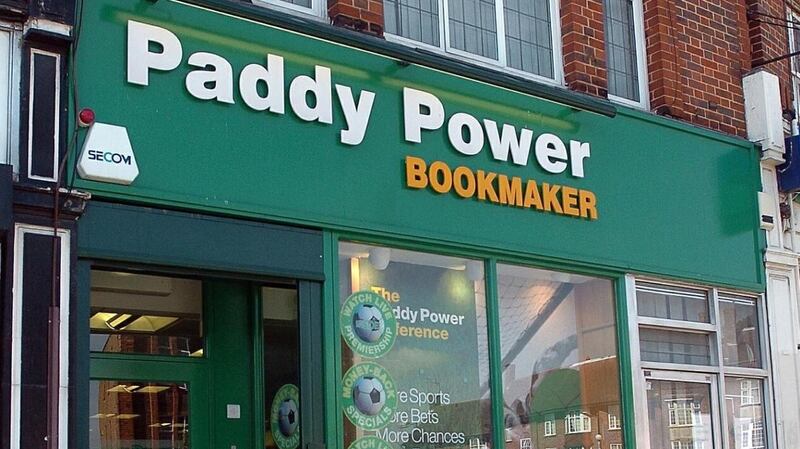

The review has hung over gaming stocks like Flutter Entertainment, the FTSE 100-listed Irish parent of Paddy Power, Betfair and Skybet, for more than a year and a half – contributing to a 50 per cent-plus slump in the company’s share price since it hit an all-time high in March 2021.

Flutter, led by Peter Jackson, would argue that it has not been waiting around for more onerous regulation, having rolled out a so-called triple-step approach to customer affordability in the UK and Ireland last year that monitors player activity and places various betting thresholds. Last September, it announced that it was putting a €500 monthly betting expenditure cap on customers under the age of 25 in the Republic (and £500 in the UK).

The company reported in May that the safer gambling measures in the UK and Ireland resulted in a financial hit of £30 million (€35.5 million) in the first quarter of this year.

Still, there’s clear self-interest at stake in upping its game, as Flutter seeks to convince authorities and increasingly powerful ESG-conscious (environmental, social and governance) investors that it can be relied upon to do the right thing – and, more importantly, try and ensure it has a sustainable business model.

There is little to suggest in reports that proposals in the White Paper – including curbs on online gambling and affordability checks – will be more stringent than Flutter had been preparing for.

But analysts reckon that there is little prospect of a relief rally until after the document is published. Johnson seems intent on sticking around until the autumn. And he has told his cabinet that he will not try to implement new policies as the Conservatives go about choosing a new leader.

A fresh drop in Flutter’s share price in recent days suggests investors expect the paper will be lying around in an in-tray for the foreseeable future.

The slide in Flutter’s share price over the past year has also been down to an easing of Covid-19 lockdowns reducing the level of people placing wagers from their bedrooms, as well as regulatory uncertainty in various jurisdictions and “an unprecedented” run of UK and Irish sports results running in favour of customers last year.

These have conspired to take the market’s focus off the large growth prospects of its US unit, in a market where commercial online sports gambling has been opening up on a state-by-state basis since the country’s supreme court moved in May 2018, to strike down a federal law banning the practice.

Flutter moved within days of the court ruling to take an initial stake in US fantasy sports website FanDuel and now owns 95 per cent of the largest player in the industry. It currently controls close to 40 per cent of a market that analysts at Citigroup estimate could ultimately be as big as $45 billion(€44 billion) in annual revenues.

So far, 35 states and the District of Columbia have legalised sports betting. As of the end of March, FanDuel was live in 15 states.

The cost of acquiring customers is not cheap. Flutter’s US operations reported $1.9 billion in revenue last year, but spent $1 billion on promotions and marketing.

Last December, FanDuel, led by chief executive Amy Howe, inked a $120 million deal spanning four years for US sports broadcaster Pat McAfee to be its media star. Still, Flutter is guiding that the US unit will be profitable from next year.

Flutter flagged in early 2021 that it was considering an initial public offering (IPO) of FanDuel, to take advantage not only of the traditional premium at which US-listed companies trade compared to European shares, but also of how hot this sector had become.

Analysts see a partial listing of the unit as offering a real catalyst for Flutter shares. Bank of United States analysts suggested in a note this week that FanDuel’s best chance at having a stab at an IPO will be when it turns profitable.

First of all, there will need to be a resolution to the standoff since early last year with Rupert Murdoch’s Fox Corporation over a right it has to buy an 18.6 per cent stake in FanDual from the Irish group.

A US arbitration hearing over a dispute about the price at which the option can be exercised got under way late last month, with a decision anticipated around October.

The Bank of United States analysts have a £160 share price target on Flutter, including a valuation it has slapped on the “US opportunity”. That’s double what the stock is currently changing hands for.

However, there’s little prospect of a FanDuel IPO in the near term, with global equity markets currently in turmoil and shares in the company’s smaller rival, DraftKings, down almost 75 per cent over the past 12 months.