The share of our income that goes on Government services such as welfare, health and education is very low by European standards. As a result, contrary to public perception, the burden of tax in Ireland is also very low.

While much concern has been expressed in recent times about a “squeezed middle”, those on middle incomes pay much less tax than they do in most other EU countries.

The relatively low level of taxation does not stop us seeking European standards of public services, but it does help to explain the fact that some services may not be as good as those available in countries such as Denmark, Germany, France and even the UK.

Countries have different preferences in terms of the quality and quantity of public services they choose to provide. Even within Europe, there is very considerable diversity of experience. The Scandinavian countries and France have chosen a high level of provision of public services combined, of course, with a high tax burden. Germany has a somewhat lower level of provision and the UK is towards the bottom of EU member states.

In 2016, Ireland will spend one of the smallest shares of national income on public services of any developed economy.

In the latter years of the 1990s, the share of GNP devoted to public expenditure fell dramatically in Ireland, reaching its lowest level in decades in 2000 (see Figure 1). While there was some recovery in 2002, an election year, it remained well under 40 per cent of GNP till 2007.

However, the recession saw a mushrooming in the bill for welfare for the unemployed and an even more significant increase in expenditure to bail out the banks. In 2010 public expenditure peaked at more than 75 per cent of GNP. Even after the banks had been paid for in 2012, public expenditure as a share of GNP was still above the EU average at 49 per cent.

But, since then, the burden of public expenditure has fallen dramatically so that next year it will be back down to the low levels of the early 2000s, about 36 per cent of GNP.

Welfare bill

The very rapid reduction in public expenditure reflects, in particular, the fall in the welfare bill as the unemployment rate has declined. It is also a result of the very low interest rates and the ability of the

National Treasury Management Agency

(NTMA) to roll over our debt at these low rates.

Finally, the rapid rise in the value of GNP since 2012 has also played a vital role in reducing the burden of public services.

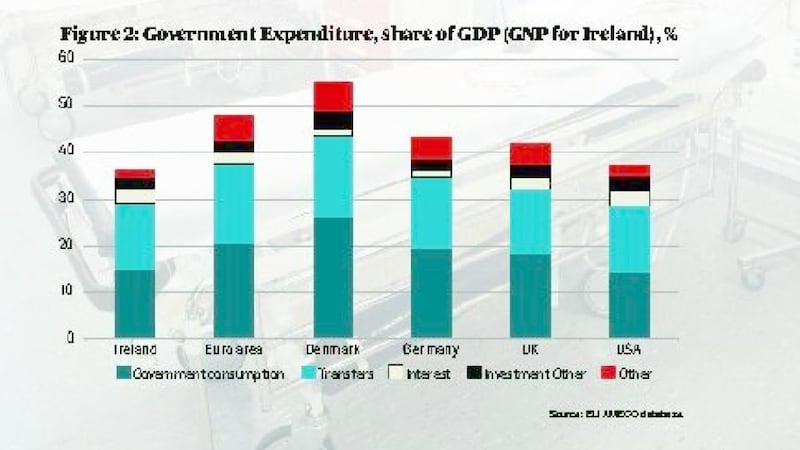

Figure 2 compares the forecast for public expenditure in Ireland in 2016 with the EU forecast for public expenditure in a number of other countries.

As mentioned earlier, Ireland’s public expenditure next year is expected to amount to about 36 per cent of GNP. By contrast, public expenditure in Denmark will amount to almost 55 per cent of GDP, while in Germany and the UK it will account for just over 40 per cent of national income.

Among major non-EU developed countries, only the United States spends as small a share of its national income on public goods and services as does Ireland.

As shown in Figure 2, the difference in spending in Ireland compared to our EU partners arises from lower spending on public consumption (eg health and education) as well as a smaller share of national income going on welfare. The pattern of expenditure in Ireland is actually very similar to that in the US.

However, in the case of the US, they spend more on their defence budget than we do in Ireland (classified as public consumption), compensating instead with lower public expenditure on health and education.

Limited resources

Public investment in Ireland is also very low by international standards. Only Germany spends as small a share of its national income on public investment as Ireland does – and there are many voices in Germany calling for an increase in investment in the coming years.

In the case of public investment, the very limited resources devoted to it in Ireland today is a result of the crisis years. In 2008, Ireland spent 6 per cent of GNP on public investment, three times as much as today.

However, during the recession, the very high interest rates facing Ireland made most investment projects look unattractive. Current low interest rates make investment more profitable, but public investment has yet to respond.

While public expenditure is very low in Ireland today, there is also clear dissatisfaction with the quality of public services available to us.

The forthcoming general election will give an opportunity for the people of Ireland to choose. We could repeat the exercise of the last decade and maintain spending at a low level, accepting the problems with the health and education services. Alternatively, we could choose to provide ourselves with better services, funded by increasing taxation.

But anyone who suggests we can have better public services with continuing low levels of taxation is deluded.

Even if we choose better public services and higher taxation, it will be a major task to deliver them efficiently. In the boom years, too many of the resources available were frittered away on price increases. This time it must be different.